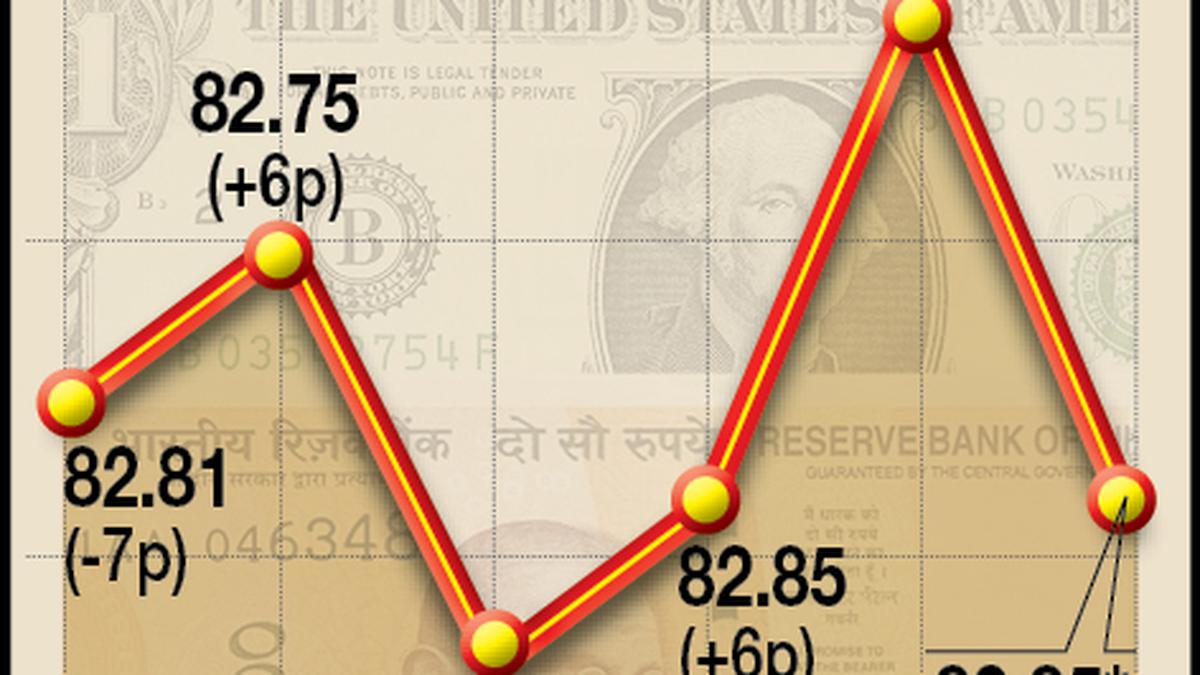

The rupee paused its three-day slide and inched up 2 paise to 83.23 against the U.S. dollar

| Photo Credit: SUDERSHAN V

The rupee paused its three-day slide and inched up 2 paise to 83.23 against the U.S. dollar in early trade on Friday amid positive cues from the domestic equity markets and a weak American currency overseas.

An upward trend in the crude oil prices and selling pressure from foreign equity investors continued to weigh on the Indian currency, forex traders said.

At the interbank foreign exchange market, the local unit opened at 83.24 and gained further to reach 83.23 against the greenback, up 2 paise from its previous close.

The rupee settled 8 paise lower at 83.25 against the dollar on Thursday, the third consecutive day of fall. It had dropped 4 paise on Monday, followed by a dip of 1 paisa on Wednesday when it closed at 83.17 against the dollar. Forex markets were closed on Tuesday on account of Dussehra.

According to analysts, the dollar retreated as the U.S. Treasury yields dropped from its record levels after the U.S. GDP data, durable goods sales orders as well as home sales numbers exceeded the estimated growth.

Besides, the European Central Bank’s decision to leave the benchmark interest rate unchanged also came on expected lines, they said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.03 per cent lower at 106.57 on Friday.

Global oil price benchmark Brent crude witnessed a sharp rise of 1.27 per cent to $89.05 per barrel.

On the domestic equity market front, the Sensex climbed 272.63 points or 0.43 per cent to 63,420.78 while the broader Nifty rose 88.20 points or 0.47 per cent to 18,945.45.

Foreign Institutional Investors sold equities worth ₹7,702.53 crore on Thursday, according to exchange data.