A worker levels iron ore in a freight train at a railway station in Karnataka.

| Photo Credit: REUTERS

This is the first of a three-part series of articles on the Indian railways, its capital expenditure and freight business.

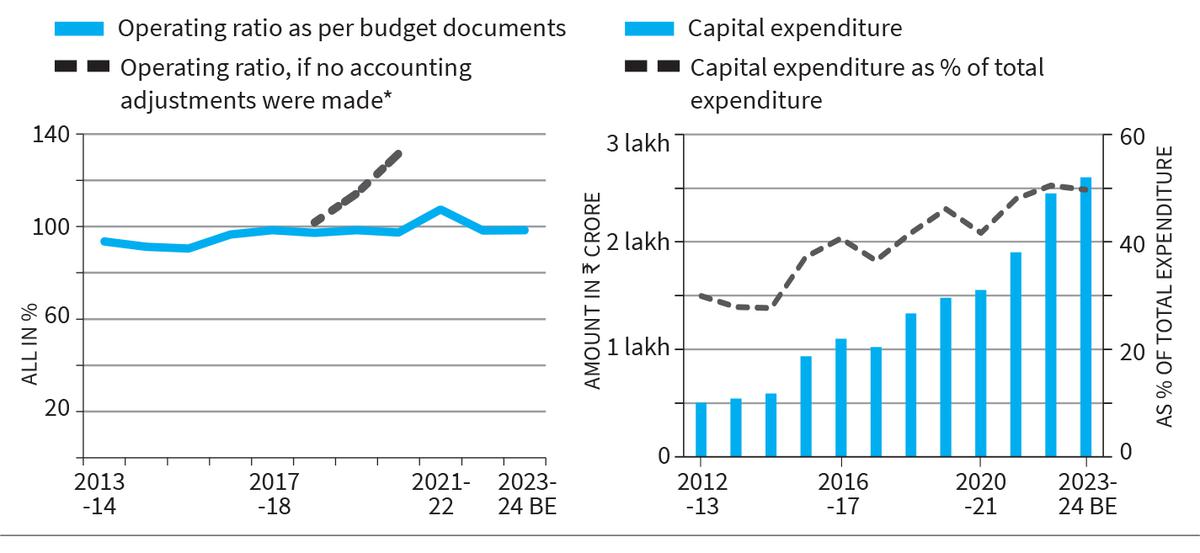

The Indian Railways (IR) has been on a spending spree with respect to capital expenditure (capex), particularly after the government merged its rail budget with the main budget. However, its operating ratio, which is the ratio of ordinary working expenses to the gross traffic receipts, has shown no improvement. A lower ratio implies better profitability and surplus for capital investment.

The trap of rising debt

Since the IR continues to have a total lack of surplus, it has been augmenting the funds raised through Gross Budgetary Support (GBS) and Extra Budgetary Resources (EBS). The merging of budgets helped this cause as GBS from the central government could be increased without much scrutiny. However, with respect to EBS, there is a price to pay. The IR’s spending on repayment of principal and interest is pegged at ₹22,229 crore and ₹23,782 crore respectively, which together make it 17% of revenue receipts, a sharp rise from less than 10% till 2015-16. It appears that this debt liability was noticed as capex relied almost entirely on GBS in this year’s budget.

Source: PRSINDIA

Despite this, the unprecedented rise in capex appears to be predicated on the premise that the IR’s operating and financial performance should not be viewed in isolation but along with its role as an engine for the growth of the country’s economy. Investment in railways boosts manufacturing and services, tax revenue for the government and allows for more job opportunities. However, a key organisation like the IR cannot be allowed to go the Air India way — the investments made should be productive for IR’s revenues.

Identifying the problem

The IR’s freight segment is profitable whereas the passenger segment makes huge losses. The Comptroller and Auditor General of India (CAG) report presented in Parliament on August 8, 2023 states that there was a loss of ₹68,269 crore in all classes of passenger services during 2021-22, with all the profit from freight traffic nullified in cross subsidising passenger services. This is nothing new for the IR but the situation has become grimmer and since any significant increase in passenger fares is unlikely, the IR has no option but to boost its freight volumes and in turn its revenue.

The annual growth in freight volume and revenue of the IR in the period April-July 2023 stand at 1% and 3% respectively, while the economy grows at 7%. This is a dismal performance. The IR’s modal share in India’s freight business has steadily decreased to approx. 27% from upwards of 80% at the time of independence.

The objective of this series is to examine how the freight business of IR can be improved. The movement of cargo by the IR is artificially divided into goods and parcels. The division is not semantic but indicates a paradigmatic difference in approach with respect to tariff rules, handling, moving and monitoring. Shippers, however, are not interested in these differences as their concern is mainly about the safe movement of their cargo from point A to B at the least cost and as fast as possible. The time has come for the IR to shed such an artificial divide so that cargo can be divided based on its characteristics as bulk and non-bulk (or value added).

While the divisions are not water tight, bulk cargo would essentially refer to large volumes of cargo (full train loads or amenable for into full train loads) which can be easily handled mechanically and non-bulk cargo would be smaller in volume and less amenable for mechanical handling.

The lessening share

The 11 commodities in the IR’s transport basket account for 90% of tonnage and revenue, of which coal is around 45% and iron ore and cement are around 10% each. Although these three still account for two thirds of the IR’s total freight volume, the share of the IR in their transport has reduced over the years. For example, coal consumption was 602 and 978 million tonnes (MT) in 2011 and 2020 respectively while the rail transport share was 420 and 587 MT respectively; the rail share fell from around to 70% to 60% in a ten-year period. Though it improved to 64% in 2023 it is still lower than what it was in 2011. Similarly, the share of exim containers moving in and out of ports hovered between 10% and 18% since its introduction in 2009-10, with the 2021-22 figure being 13%. It should be noted that private container train operation policy, initiated in 2006 to boost the rail share of container movement, has not made any significant dent in improving the share.

Further adding to the woes of the IR is the constantly fluctuating key index of Net Tonne Kilometres (NTKM), which fell for two successive years in 2015-16 and 2016-17 by 4% and 5% over the preceding years — first time such a fall has happened for two consecutive years. Demonetisation perhaps had some effect in the fall as NTKM recovered in 2017-18 by 11% registering an increase of 1.6% in the three-year period starting 2015-18. However, NTKM continued to fluctuate as it fell again in 2019-20 by 4%. In the seven-year period ending 2021-22, NTKM grew annually at the rate of 3.5% — much less than the road transport growth rate.

Sudhanshu Mani is leader of the Vande Bharat project and a rail consultant and M. Ravibabu is founding member, Anekdhara, a public policy portal.