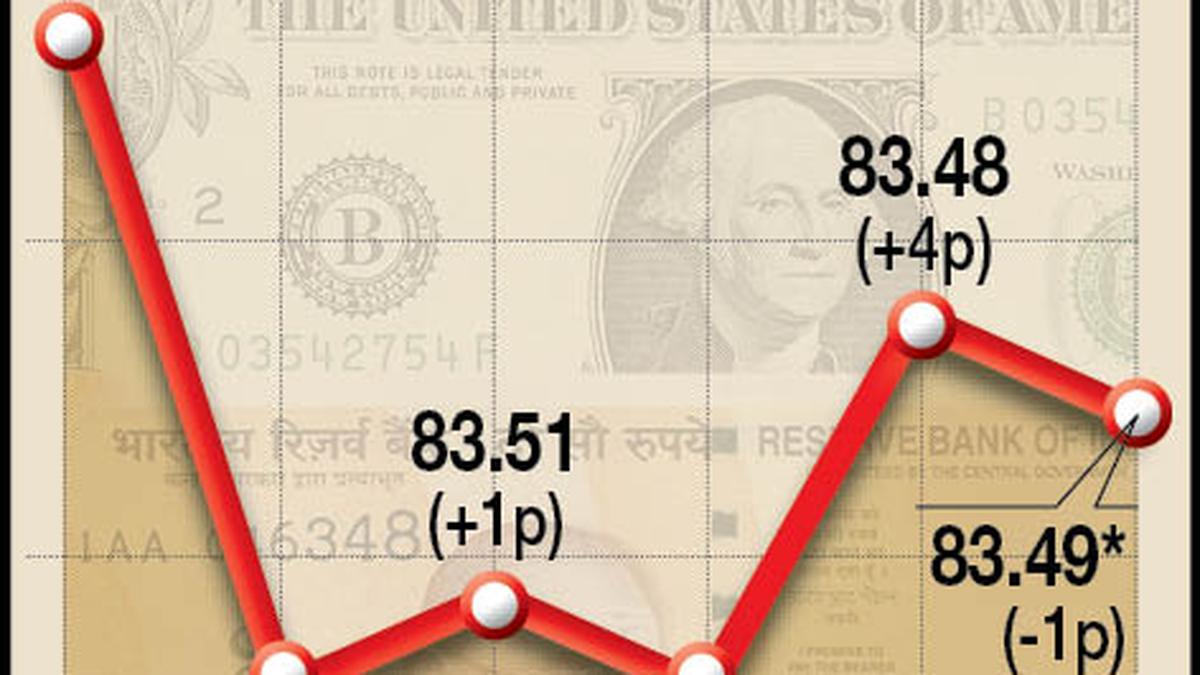

The rupee stayed range-bound and settled 1 paisa lower at 83.49 (provisional) against the U.S. dollar on Friday, as the support from positive domestic equities was negated by elevated crude oil prices.

Forex traders said significant foreign fund outflows dented investors’ sentiments.

At the interbank foreign exchange market, the local unit traded in a narrow range. It opened at 83.48, and touched an intraday high of 83.46 and a low of 83.51 during the day. The domestic unit finally settled for the day at 83.49 (provisional), down 1 paisa from its previous close.

On May 09, the rupee closed at 83.48 against the American currency.

The Indian rupee traded on a flat note. Positive domestic markets and a weak U.S. dollar supported the rupee, however, a rise in crude oil prices and sustained foreign fund outflows capped sharp gains, said Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was at 105.23, higher by 0.01% as the US dollar declined on rising weekly unemployment claims from the U.S.

Weekly unemployment claims rose to 231,000 vs 209,000 in the prior week and the forecast of 212,000.

“We expect the rupee to trade with a slight negative bias and the US dollar may rise again amid hawkish Fed speak and safe-haven demand amid geopolitical tensions in the Middle East,” Mr. Choudhary said.

Selling pressure by foreign investors and rising global crude oil prices may also pressurise the rupee. However, a rise in risk appetite in global markets may support the rupee at lower levels. “Traders may take cues from India’s IIP data and Michigan consumer sentiment data from the US. USD-INR spot price is expected to trade in a range of ₹83.30 to ₹83.75,” Mr. Choudhary added.

Brent crude futures, the global oil benchmark, rose 0.62% to $84.40 per barrel.

On the domestic equity market, the 30-share BSE Sensex advanced 260.30 points, or 0.36% to close at 72,664.47 points. The broader NSE Nifty settled 97.70 points or 0.44% higher at 22,055.20.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Thursday as they offloaded shares worth ₹6,994.86 crore, according to exchange data.