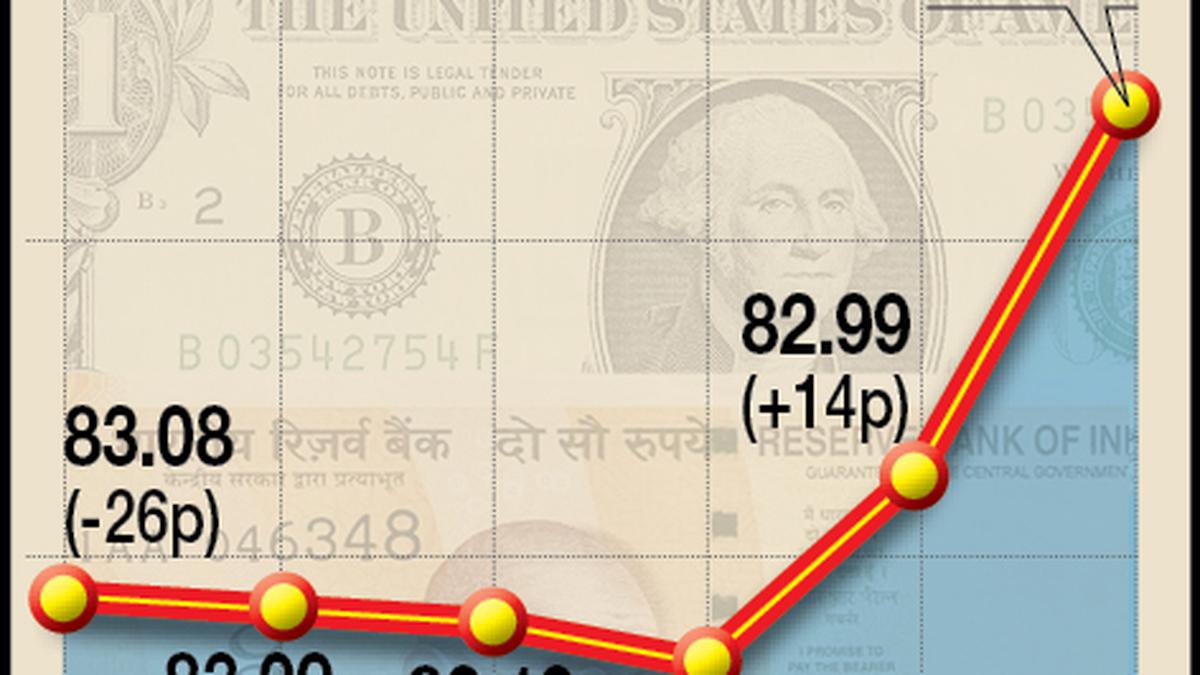

The rupee strengthened for the second consecutive session and appreciated by 28 paise, registering the highest single-day gain in nearly two months, to close at 82.71 (provisional) against the U.S. dollar on Wednesday.

Forex traders said IPO-driven inflows and positive tone in the domestic markets supported the upward move. Softening of crude oil prices also supported the domestic unit.

However, FII outflows and a strong U.S. dollar capped sharp gains.

At the interbank foreign exchange market, the local unit opened at 83.02 against the U.S. dollar and moved in a range of 82.68 to 83.02 in the day trade.

The rupee finally settled 28 paise higher at 82.71 (provisional) against the previous close. Earlier, the Indian currency had witnessed the highest single-day gain of 35 paise on June 16 this year.

On Tuesday, the rupee had recovered from its all-time low levels and settled higher by 14 paise at 82.99 against the U.S. dollar.

“We do not see any sharp appreciation in the rupee as dismal economic data from Europe may lead to a risk averse market which may weigh on riskier currencies,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

In that case, the U.S. dollar would gain. Any further inflows due to the upcoming IPOs may also support rupee. However, a strong dollar and hawkish comments from U.S. Federal officials may support the greenback which may put downside pressure on rupee, Choudhary said.

“Trades may watch out for PMI numbers from the U.S., while investors may remain cautious ahead of Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on Friday. The USDINR spot price is expected to trade in a range of ₹82.40 to ₹83.20,” Choudhary added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.34% to 103.91.

Brent crude futures, the global oil benchmark, declined 1.11% to $83.10 per barrel.

On the domestic equity market front, the BSE Sensex closed 213.27 points or 0.33% higher at 65,433.30. The broader NSE Nifty advanced 47.55 points or 0.25% to 19,444.00.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Tuesday as they offloaded shares worth ₹495.17 crore, according to exchange data.