Equity benchmark indices Sensex and Nifty hit their record peaks in early trade on Thursday

| Photo Credit: The Hindu

Equity benchmark indices Sensex and Nifty hit their record peaks in early trade on Thursday in continuation of their ongoing rally, amid a largely firm trend in Asian markets along with buying in IT and banking stocks.

Rallying for the 10th day running, the 30-share BSE Sensex climbed 304.06 points to 67,771.05 — its all-time peak — in early trade. The Nifty advanced 97.65 points to reach its lifetime high of 20,167.65.

Among the Sensex firms, Tata Steel, Tech Mahindra, Wipro, State Bank of India, Power Grid and JSW Steel were the major gainers.

Bajaj Finance emerged as the only laggard.

In Asian markets, Seoul and Shanghai were trading in the positive territory while Hong Kong quoted lower.

The U.S. markets ended on a mixed note on Wednesday.

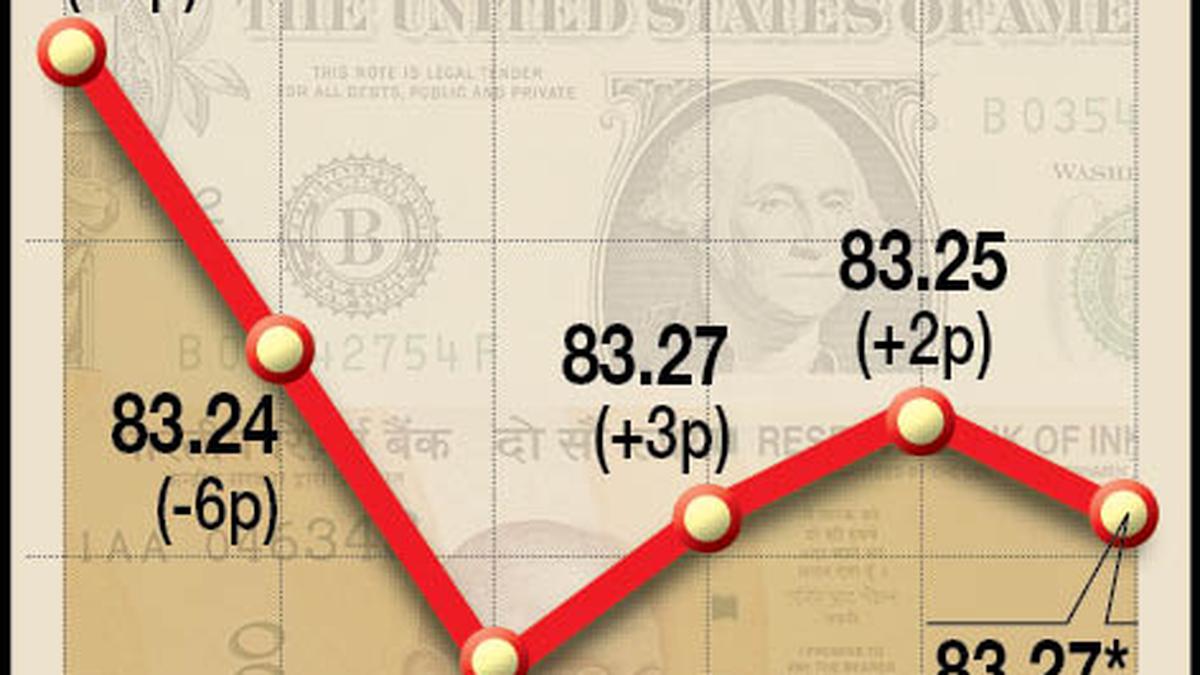

Global oil benchmark Brent crude climbed 0.42 per cent to USD 92.28 a barrel.

“The August U.S. CPI figures reinforces speculation that the Federal Reserve may pause its rate hikes in next week’s policy meeting. However, the technical landscape continues to be bullish with Nifty bulls now aiming aggressively at the psychological 20,500-mark.

“However, persistent FII selling and expensive valuations could limit the upside going ahead,” said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,631.63 crore on Wednesday, according to exchange data.

“Inflation data from the U.S. present a mixed picture. While the CPI inflation data for August has come at 3.7 per cent against expectations of 3.6 per cent, core inflation was on expected lines coming at 4.3 per cent. So the market thinking is that the Fed is likely to pause in September,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The BSE benchmark had settled at 67,466.99, up 245.86 points or 0.37 per cent on Wednesday. The broader Nifty ended above the 20,000-mark for the first time, rallying 76.80 points or 0.38 per cent to 20,070, its all-time closing high.