Foreign currency traders work inside a trading firm behind the signs of various world currencies, in Mumbai.

| Photo Credit: REUTERS

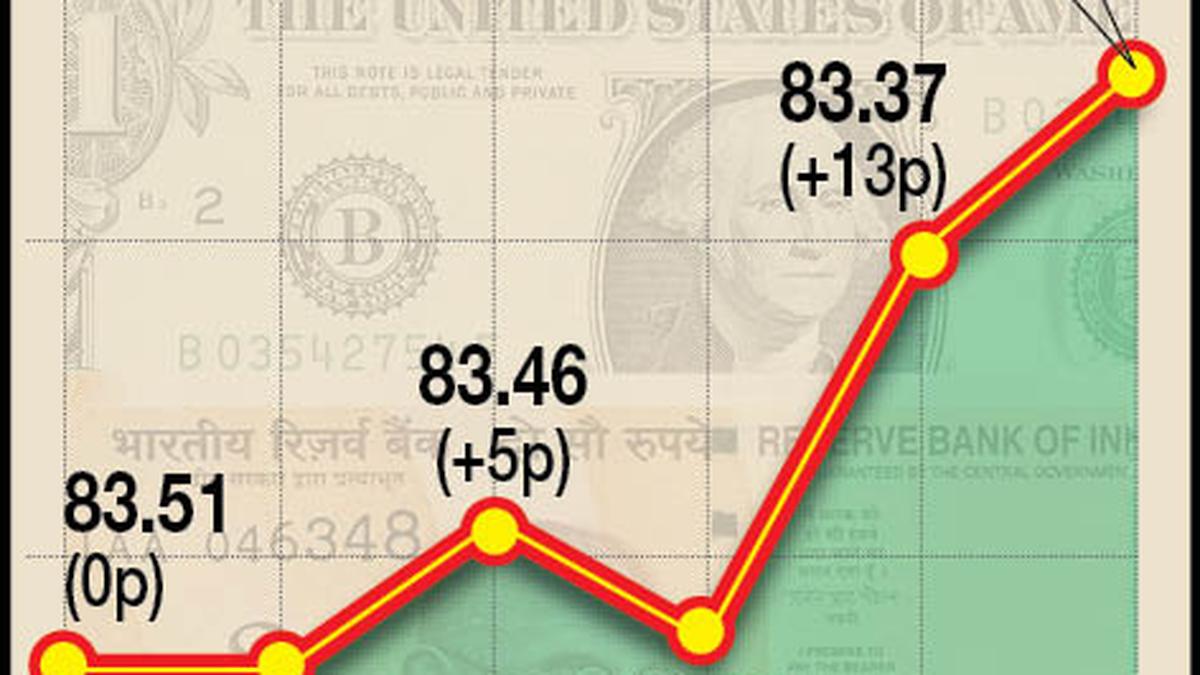

The rupee witnessed a range-bound trading against the U.S. dollar in early trade on Friday, as the support from positive domestic equities was negated by firm crude oil prices.

Forex traders said the rupee opened on a flat note as losses in dollar index, and positive Asian currencies supported sentiments, while rise in crude oil prices dented investors.

At the interbank foreign exchange, the rupee was trading in a narrow range. It opened at 82.73 against the dollar, and touched a low of 82.77 and a high of 82.72.

On Thursday, the rupee closed at 82.74 against the U.S. currency.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.14% to 102.40.

Brent crude futures, the global oil benchmark, was trading 0.16% higher at $85.28 per barrel.

Finrex Treasury Advisors LLP Head of Treasury Anil Kumar Bhansali said the rupee opened flat “due to losses in dollar index and small gains in Asian currencies while a rise in oil prices. RBI was seen at 82.80 and could be seen again selling USD to keep rupee in a range given the amount of reserves it has accumulated.”

In the domestic equity market, the 30-share BSE Sensex advanced 207.71 points or 0.32% to 65,448.39. The broader NSE Nifty was up 70.20 points or 0.36% to 19,451.85.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Thursday as they offloaded shares worth ₹317.46 crore, according to exchange data.