The rupee pared its initial gains and settled for the day lower by 2 paise at an all-time low of 83.10 (provisional) against the U.S. dollar on Thursday, weighed down by a strong greenback overseas and a negative trend in domestic equities.

Forex traders said rupee is likely to trade with a negative bias on risk aversion in global markets and rising U.S. dollar.

At the interbank foreign exchange, the domestic unit opened at 83.10 against the dollar, and it finally ended the day at the same level 83.10 (provisional), registering a fall of 2 paise from its previous close.

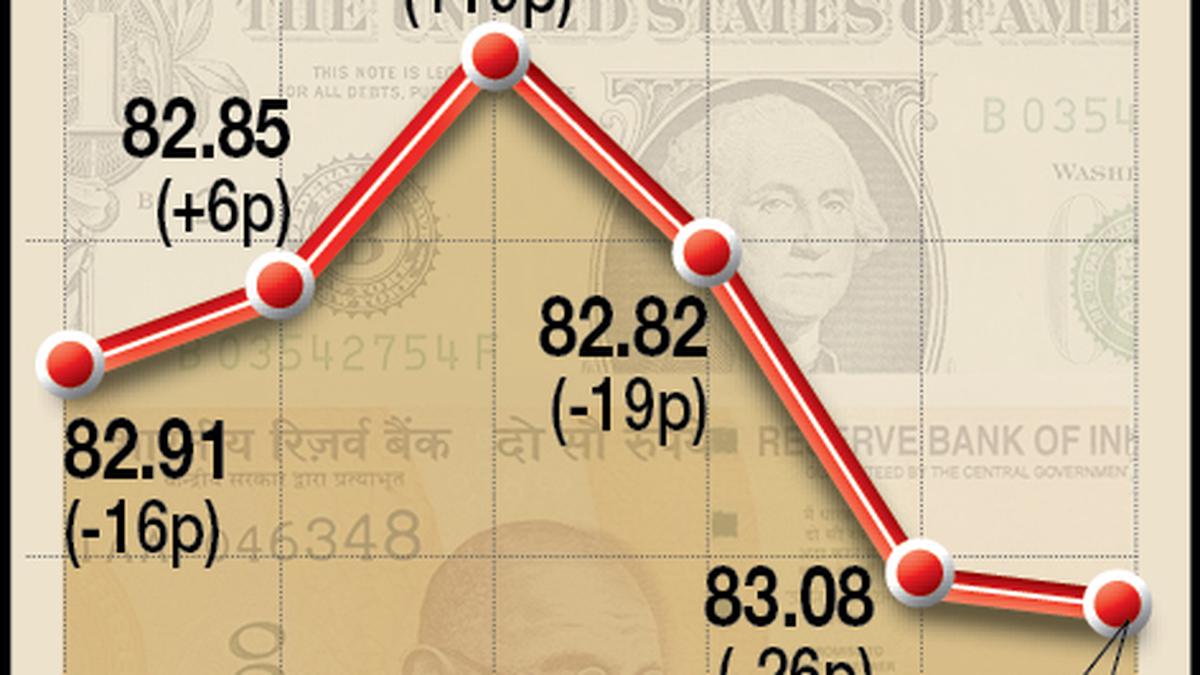

During the session, the local unit touched a peak of 82.99 and a low of 83.16.

On Monday, the rupee depreciated 26 paise to settle at an all-time low of 83.08 against the U.S. dollar.

Forex market was closed on Tuesday and Wednesday on account of Independence Day and Parsi New Year, respectively.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.05% to 103.48.

Brent crude futures, the global oil benchmark, advanced 0.52% to $83.88 per barrel.

“The Indian rupee traded lower in line with the Asian currencies and risk-averse sentiments,” said Dilip Parmar, Research Analyst, HDFC Securities.

The greenback enjoyed good momentum reacting to July FOMC minutes that signalled clear openness to more tightening.

“We remain bullish on the pair and a crossing of 83.30 will pave the way for 83.50 and 83.70 while expected to hold the support at 82.70,” Mr. Parmar added.

On the domestic equity market front, the 30-share BSE Sensex closed 388.40 points or 0.59% lower at 65,151.02 points. The broader NSE Nifty declined 99.75 points or 0.51% to close at 19,365.25 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Wednesday as they purchased shares worth ₹722.76 crore, according to exchange data.