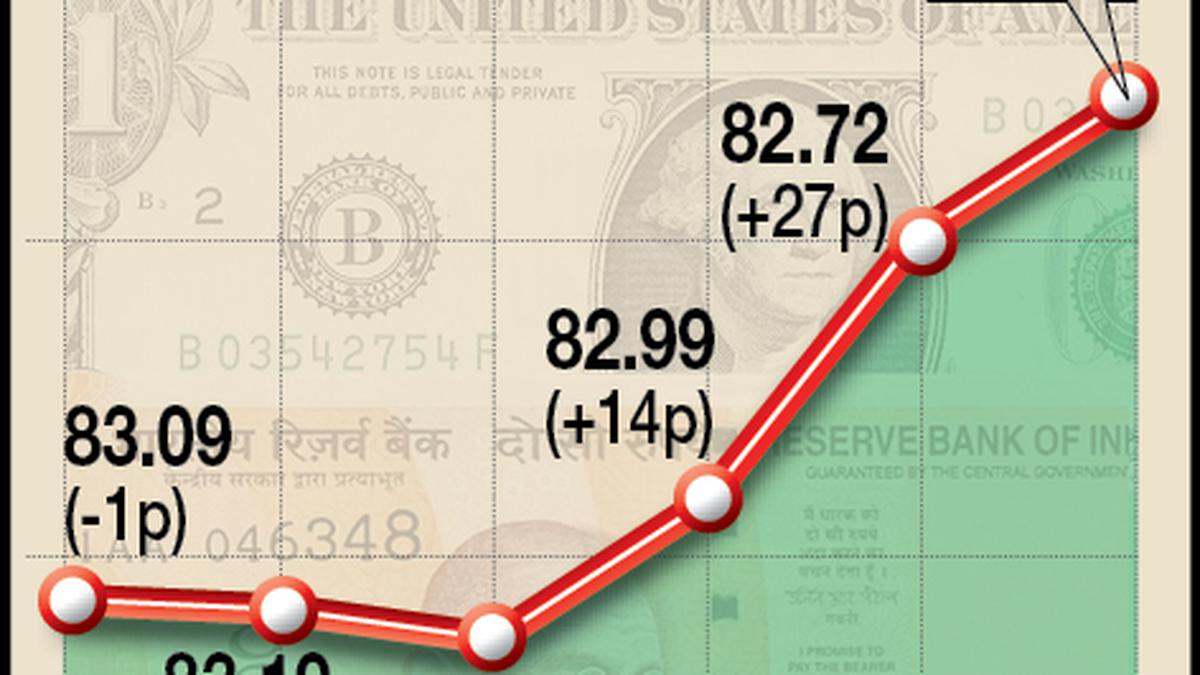

The rupee appreciated by 14 paise to settle at 82.58 (provisional) against the U.S. dollar on Thursday, marking its third straight day of gains on the back of softening crude oil prices and foreign funds inflows.

The upward trend in the past three sessions led to a gain of 55 paise in the Indian currency, rebounding from its all-time low level of 83.11 against the greenback witnessed on Monday.

According to reports, the rupee’s sharp gain was attributed to the Reserve Bank of India’s move to prevent banks from short-term trading in offshore currency markets.

The cautious move by investors ahead of the BRICS summit and U.S. Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium restricted the upward movement of the dollar even as negative sentiment in the domestic equity markets weighed on the Indian currency, forex analysts said.

At the interbank foreign exchange, the domestic unit opened strong at 82.55 and moved in the range of 82.36 and 82.61 against the American currency. It finally settled at 82.58 (provisional) against the greenback, registering a gain of 14 paise over its previous close.

On Wednesday, the rupee registered the highest single-day gain in more than two months and appreciated by 27 paise to close at 82.72 against the dollar. Earlier, the domestic unit witnessed the maximum intra-day gain of 35 paise on June 16 this year.

Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas said, “Indian rupee gained for the third consecutive day on weakening U.S. dollar and easing crude oil prices. The rupee also gained on reports that the Reserve Bank of India has asked banks not to indulge in short-term trading in the offshore markets.” On Wednesday, the dollar initially gained on disappointing PMI data from the Eurozone and the UK but lost its initial gains on weaker-than-expected manufacturing and services PMI from the U.S.

Mr. Choudhary said the rupee is expected to trade with a “slight positive bias on extended weakness in the US dollar and retreating crude oil prices”. However, weak domestic markets may cap the upside.

“Traders may remain cautious ahead of weekly unemployment claims and durable goods orders data from the U.S. while investors may remain cautious ahead of Fed Chair Jerome Powell’s speech at Jackson Hole Symposium tomorrow. USDINR spot price is expected to trade in a range of ₹82.20 to ₹82.85,” he added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.20% to 103.62.

Global oil benchmark Brent crude futures climbed 0.37% to $83.52 per barrel.

On the domestic equity market front, the BSE Sensex closed 180.96 points or 0.28% lower at 65,252.34. The broader NSE Nifty declined 57.30 points or 0.29% to 19,386.70.

Foreign institutional investors (FIIs) turned net buyers in equities on Wednesday as they purchased shares worth ₹617 crore, according to exchange data.