Image used for representational purpose only.

| Photo Credit: Reuters

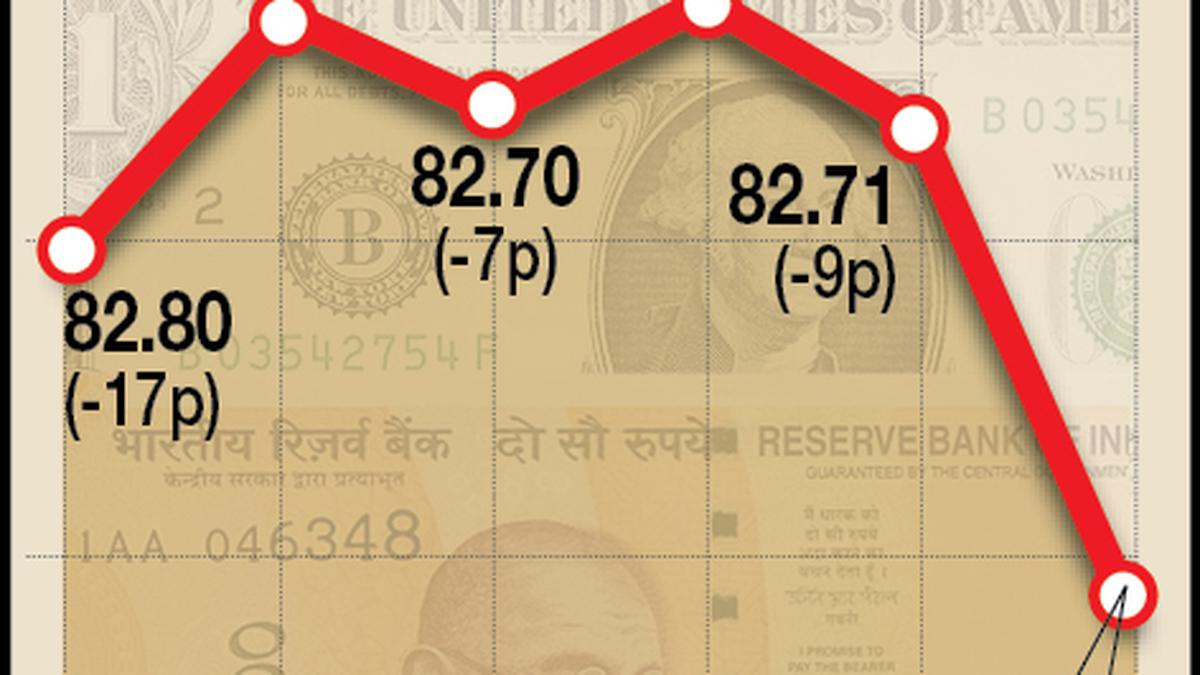

The rupee recovered from its all-time low levels and appreciated by 10 paise to 83.13 against the U.S. dollar in early trade on Friday, tracking a positive trend in domestic equities.

Forex traders said the rupee is trading in a narrow range as firm crude oil prices and the strength of the American currency in the overseas market dented investor sentiments, while positive domestic equities cushioned the downside.

At the interbank foreign exchange, the domestic unit opened at 83.13, registering a rise of 10 paise over its last close.

On Thursday, the rupee depreciated 10 paise to its lifetime low of 83.23 against the U.S. dollar.

Forex traders expect the rupee to trade with a negative bias on a strong dollar and elevated crude oil prices. Disappointing European data may further support the dollar.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, fell marginally by 0.15% to 104.89.

Brent crude futures, the global oil benchmark, fell 0.61% to $89.37 per barrel.

In the domestic equity market, the 30-share BSE Sensex was trading 168.59 points or 0.25% higher at 66,434.15. The broader NSE Nifty advanced 41.80 points or 0.21% to 19,768.85.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Thursday as they offloaded shares worth ₹758.55 crore, according to exchange data.