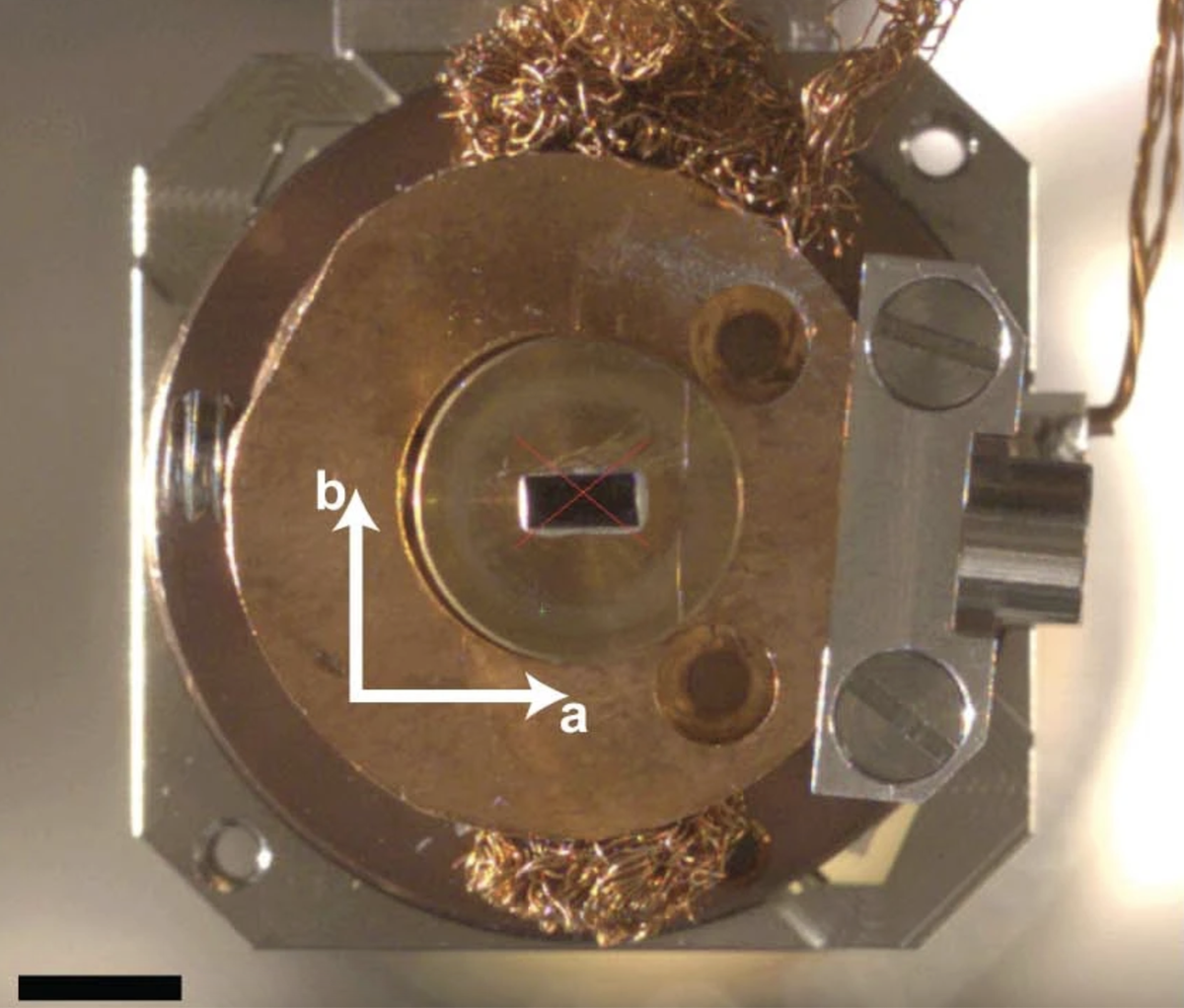

Hunter Biden, son of U.S. President Joe Biden. File

| Photo Credit: Reuters

Hunter Biden sued the Internal Revenue Service (IRS) on September 18, alleging that two agents who claimed interference into the case against him wrongly shared his personal tax information amid escalating legal and political struggles as the 2024 election looms.

The suit says the agents “targeted and sought to embarrass Mr. Biden.” Mr. Biden says federal whistleblower protections sought by the agents don’t include the sharing of confidential information in press interviews and testimony before Congress.

The suit comes as a long-running investigation into Hunter Biden continues to unfold against a sharply political backdrop, including an impeachment inquiry aimed at his father, President Joe Biden.

Hunter Biden was indicted days ago on federal firearms charges alleging that he lied about his drug use to buy and possess a gun in October 2018. His defense attorneys have indicated they plan to fight the charges. The case could be on track toward a possible high-stakes trial as the 2024 election looms.

The new civil lawsuit filed in Washington alleges the improper disclosures included the specific tax years under investigation, deductions and allegations about liability. While the suit doesn’t question the investigation itself, it seeks to “force compliance with federal tax and privacy laws” and stop the spread of “unsubstantiated allegations” and “unlawful disclosure” of his tax information.

IRS supervisory special agent Greg Shapley, and a second agent, Joe Ziegler, have claimed there was pattern of “slow-walking investigative steps” into Hunter Biden in testimony before Congress. Both have denied political motivations. They have alleged that the prosecutor overseeing the investigation, Delaware U.S. Attorney David Weiss, didn’t have full authority to bring charges in other jurisdictions.

Wiess, who was originally appointed by former President Donald Trump and kept on to oversee the Hunter Biden probe, has denied that he lacked authority to bring charges. Attorney General Merrick Garland has also said Weiss had “complete authority.” Still, Wiess sought and was granted special counsel status last month, giving him broad authority to investigate and report out his findings.

Hunter Biden had been expected to plead guilty to misdemeanor charges that he failed to pay taxes on time as part of a plea deal with prosecutors that also included an agreement on the gun charge. That deal, however, imploded in court after a judge raised questions about it. Republicans had decried the plea agreement as a “sweetheart deal.” The IRS and lawyers for the two men did not immediately return messages seeking comment.