A man walks past the new logo of the Bombay Stock Exchange (BSE) building in Mumbai. File

| Photo Credit: Reuters

Equity benchmark indices fell in early trade on September 20 in tandem with weak trends in global markets ahead of the U.S. Federal Reserve’s interest rate decision.

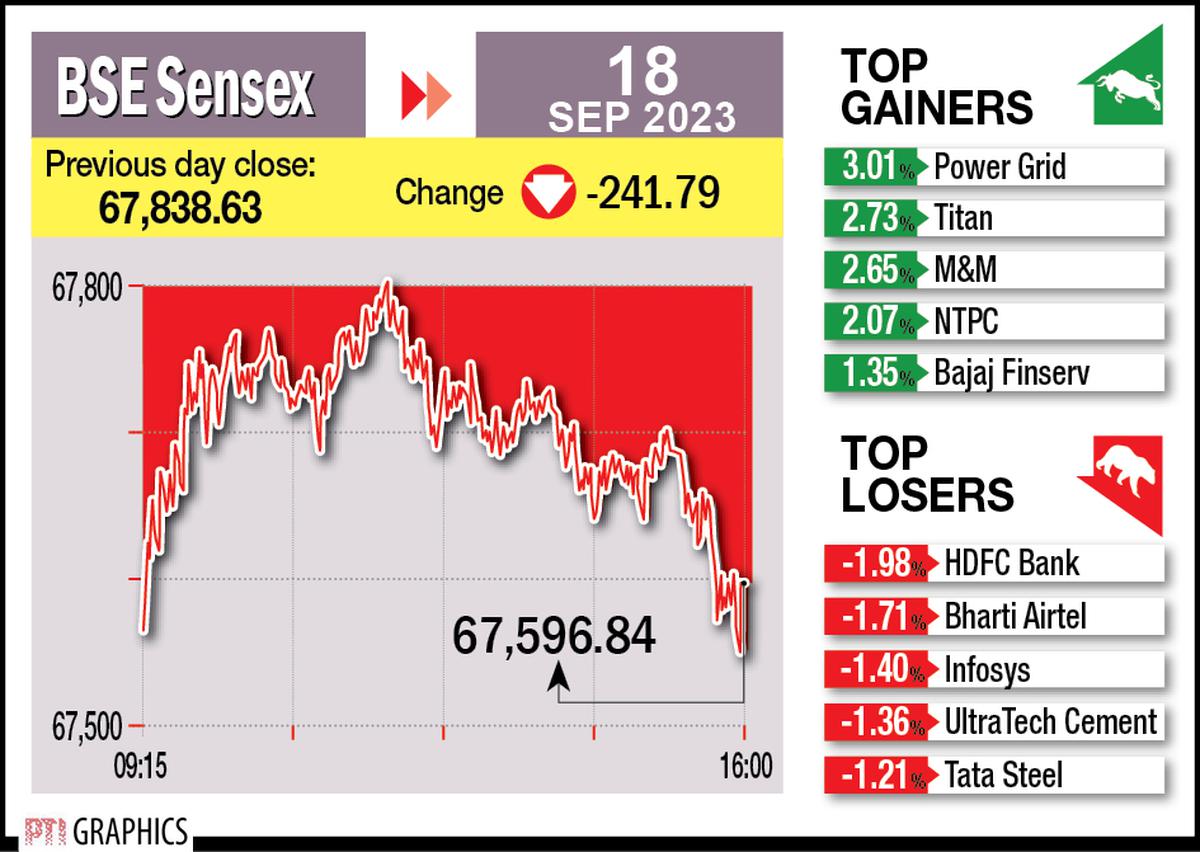

Foreign fund outflows and a weak trend in index major HDFC Bank also added to the overall bearish trend.

Falling for the second day running, the 30-share BSE Sensex tumbled 611.48 points to 66,985.36. The Nifty declined 164.4 points to 19,968.90.

Among the Sensex firms, HDFC Bank fell the most and quoted over 3% lower. Reliance Industries, Bharti Airtel, Maruti, Titan and Hindustan Unilever were the other major laggards.

NTPC, IndusInd Bank, Axis Bank and Mahindra & Mahindra were among the gainers.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong were trading lower.

The U.S. markets ended in the negative territory on September 19.

“Markets may struggle in early Wednesday trade amid weak global cues as investors are likely to maintain caution ahead of the outcome of the U.S. FOMC [Federal Open Market Committee] meeting on interest rates later today. Nervousness will prevail as besides the U.S. Fed meeting, the BoE [Bank of England], the BoJ [Bank of Japan] are also scheduled to meet this week on their decision on interest rates,” Prashanth Tapse, senior VP [Research], Mehta Equities Ltd., said in his pre-opening market comment.

Global oil benchmark Brent crude fell 0.99% to $93.41 a barrel.

“There are too many challenges for the market in the near-term. Brent crude at $94, the dollar index above 105, the U.S. bond yield at 5.09% and the INR at record lows against the dollar are strong headwinds,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,236.51 crore on September 18, according to exchange data.

Equity markets were closed on September 19 on account of Ganesh Chaturthi.

Snapping its 11-day rally, the BSE benchmark fell 241.79 points or 0.36% to settle at 67,596.84 on September 18. The broader Nifty declined 59.05 points or 0.29% to end at 20,133.30.