The rupee strengthened by 6 paise to 83.26 against the U.S. dollar in early trade on September 20 on easing global crude oil prices and rising appetite for riskier assets.

However, a sell-off in the domestic equity markets and a strong American currency against major rivals overseas restricted the rupee’s rise, traders said.

At the interbank foreign exchange, the domestic unit opened at 83.22 against the dollar and then slipped to 83.26, registering a gain of 6 paise over its previous close.

In the initial trade, the domestic unit was moving in a tight range of 83.27-83.22 against the American currency.

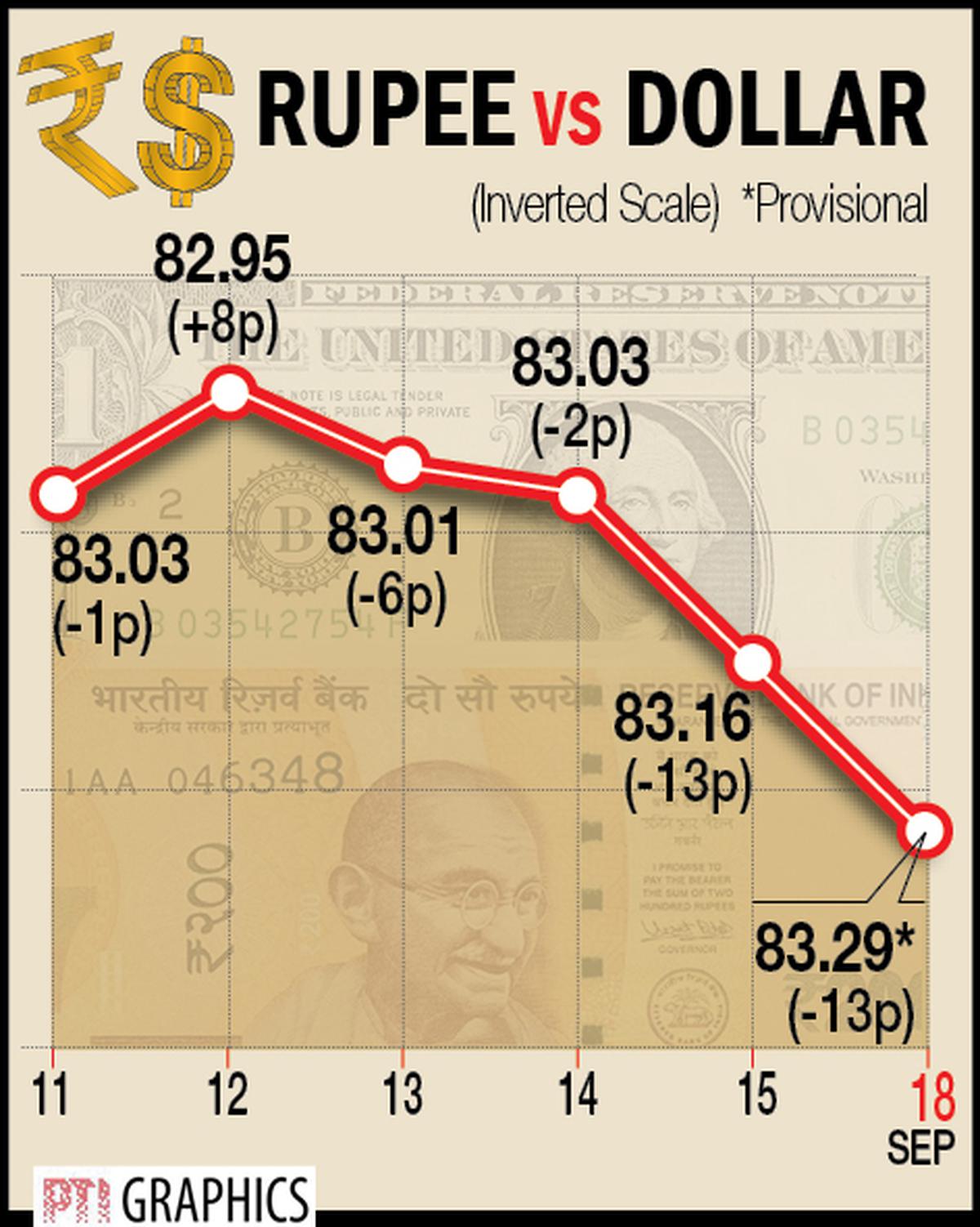

In the previous session on September 18, the rupee had settled at an all-time low of 83.32 against the dollar.

Currency markets were closed on September 19 on account of Ganesh Chaturthi.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was almost unchanged at 104.83.

Brent crude futures, the global oil benchmark, fell 1% to $93.40 per barrel.

In the domestic equity market, the 30-share BSE Sensex was trading 307.27 points or 0.45% lower at 67,289.57. The broader NSE Nifty declined 100.75 points or 0.5% to 20,032.55.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on September 18 as they sold shares worth ₹1,236.51 crore, according to exchange data.