Image used for representational purpose only.

| Photo Credit: PTI

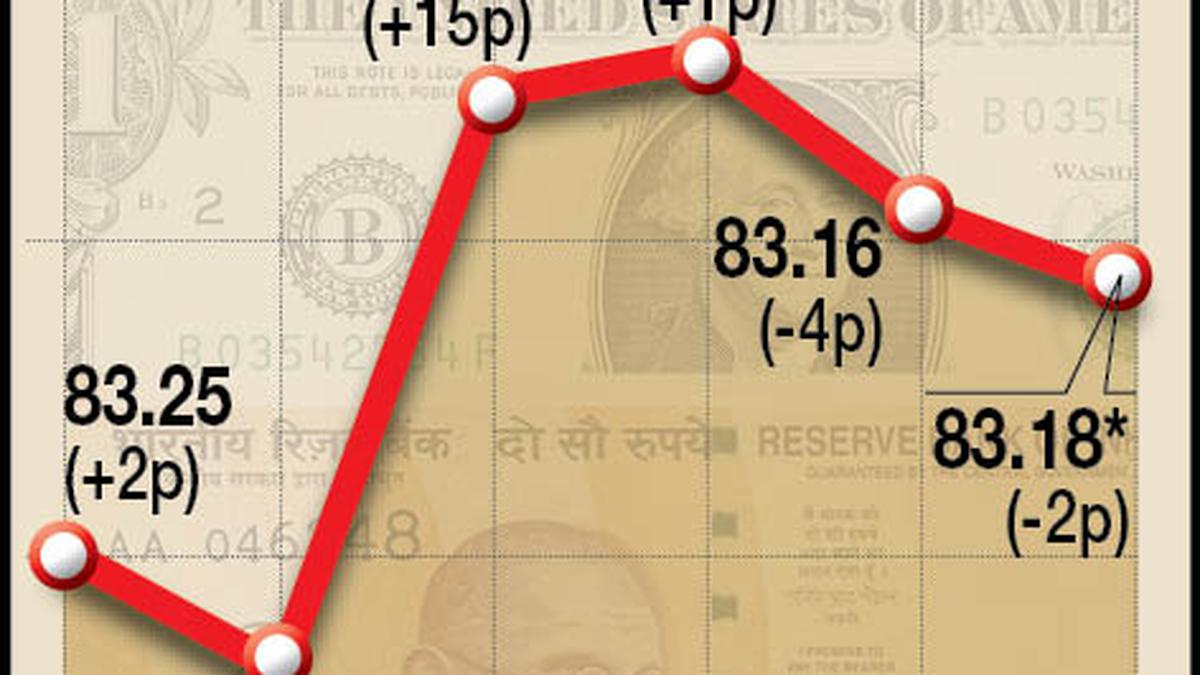

The rupee consolidated in a narrow range and settled 5 paise higher at 83.06 (provisional) against the U.S. dollar on September 21 as crude oil price receded from its elevated level.

The rupee was also weighed down by a rising dollar index, following hawkish comments from U.S. Federal Reserve officials, forex traders said.

Moreover, investors remained cautious ahead of the Bank of England and Bank of Japan policy decisions, they added.

At the interbank foreign exchange market, the rupee opened at 83.16 against the U.S. dollar and settled at 83.06 (provisional), registering a rise of 5 paise from its previous close.

During the session, the domestic unit witnessed an intra-day high of 83.02 and a low of 83.17.

In the previous session, the rupee staged a sharp rebound from its lifetime low levels and surged by 21 paise to close at 83.11 against the U.S. dollar.

“Indian rupee headed south after a flat opening amid a hawkish signal from FOMC, which dragged the global risk-assets lower,” said Dilip Parmar, Research Analyst, HDFC Securities.

However, the rupee managed to end the session with minor losses supported by the retracement in the crude oil prices and probable central bank interventions, Mr. Parmar added.

Market participants are in a wait-and-watch mode ahead of the Bank of England and Bank of Japan policy decision, he said.

“The dollar is expected to bode well amid policy divergence and a better U.S. macro environment compared to other developing nations,” he said.

The trend for $/₹remains bullish, following broad-based strength in the greenback. The pair has resistance at 83.30 and support at 82.90, he added.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.18% to 105.51.

Brent crude futures, the global oil benchmark, fell 1.05% to $92.55 per barrel.

In the domestic equity market, the 30-share BSE Sensex was trading 570.60 points or 0.85% lower at 66,230.24. The broader NSE Nifty declined 159.05 points or 0.8% to 19,742.35.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Wednesday as they offloaded shares worth ₹3,110.69 crore, according to exchange data.