Image used for representational purpose only.

| Photo Credit: Reuters

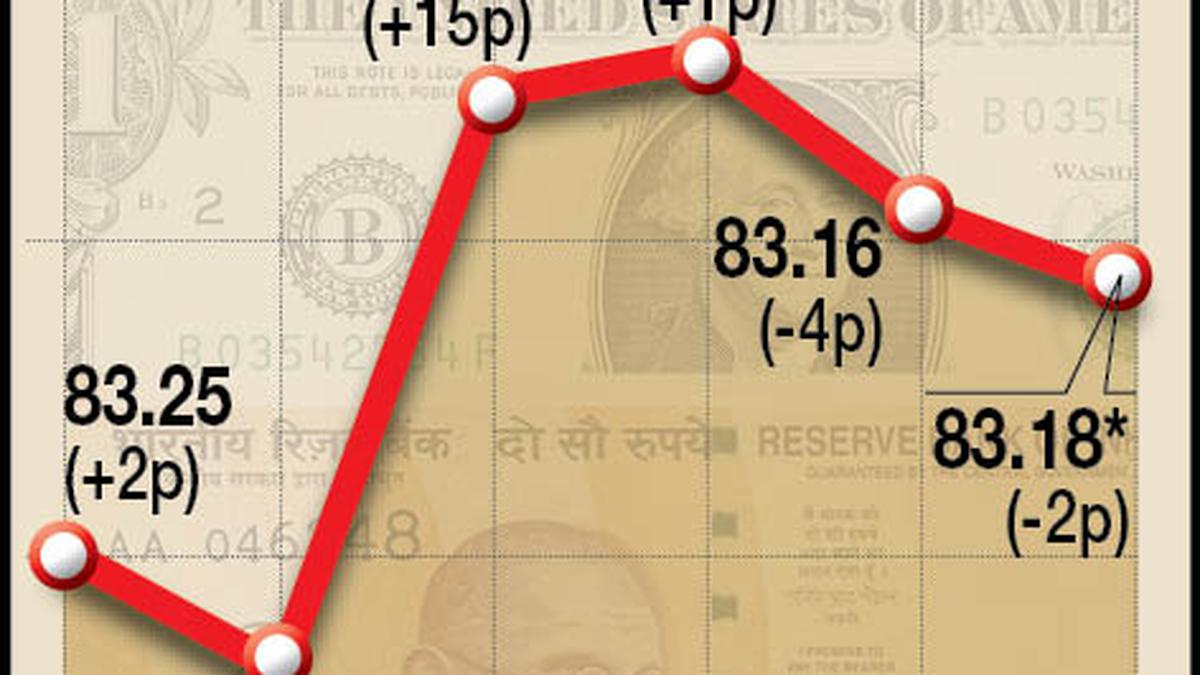

The rupee declined by 20 paise to settle at 83.14 (provisional) against the U.S. dollar on September 25 due to rising crude oil prices and a strong American currency against major rivals overseas.

Subdued equity markets and withdrawal of foreign funds also weighed on the domestic currency, forex traders said.

At the interbank foreign exchange market, the local unit opened weak at 83.04 and traded between a high of 83.04 and a low of 83.15 against the greenback.

It finally settled at 83.14 (provisional) against the dollar, registering a fall of 20 paise from the previous close.

On Friday, the rupee climbed 19 paise to close at 82.94 against the U.S. dollar.

Friday’s gain in the rupee was attributed to JP Morgan’s announcement that it will include Indian government securities in its global bond index starting June 2024, a move which is expected to bring in $25-30 billion of inflows into the Indian debt market.

On the other hand, the dollar strengthened due to an increased month-end demand of the American currency by importers and rising U.S. Treasury yield amid concerns of further interest rate hikes by the U.S. Federal Reserve.

Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas, said, “Indian rupee declined on Monday on a strong dollar and weak domestic equities. Selling pressure from FIIs also put downside pressure on the rupee. US.. dollar gained on hawkish FOMC last week”.

He said the rupee is likely to trade with a slight negative bias on strong dollar and risk aversion in global markets.

“FII outflows and elevated crude oil prices may put further downside pressure on the domestic currency. However, any intervention by the RBI may support the rupee at lower levels. $/₹spot price is expected to trade in a range of ₹82.75 to ₹83.60,” Mr. Chaudhary said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose by 0.08% to 105.67.

Brent crude futures, the global oil benchmark, advanced 0.45% to $93.69 per barrel.

On the domestic equity market front, the BSE Sensex closed 14.54 points or 0.02% higher at 66,023.69. The broader NSE Nifty settled flat at 19,674.55.

India’s foreign exchange reserves declined by $867 million to $593.037 billion in the week ended September 15, the Reserve Bank said on Friday.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Friday as they offloaded shares worth ₹1,326.74 crore, according to exchange data.