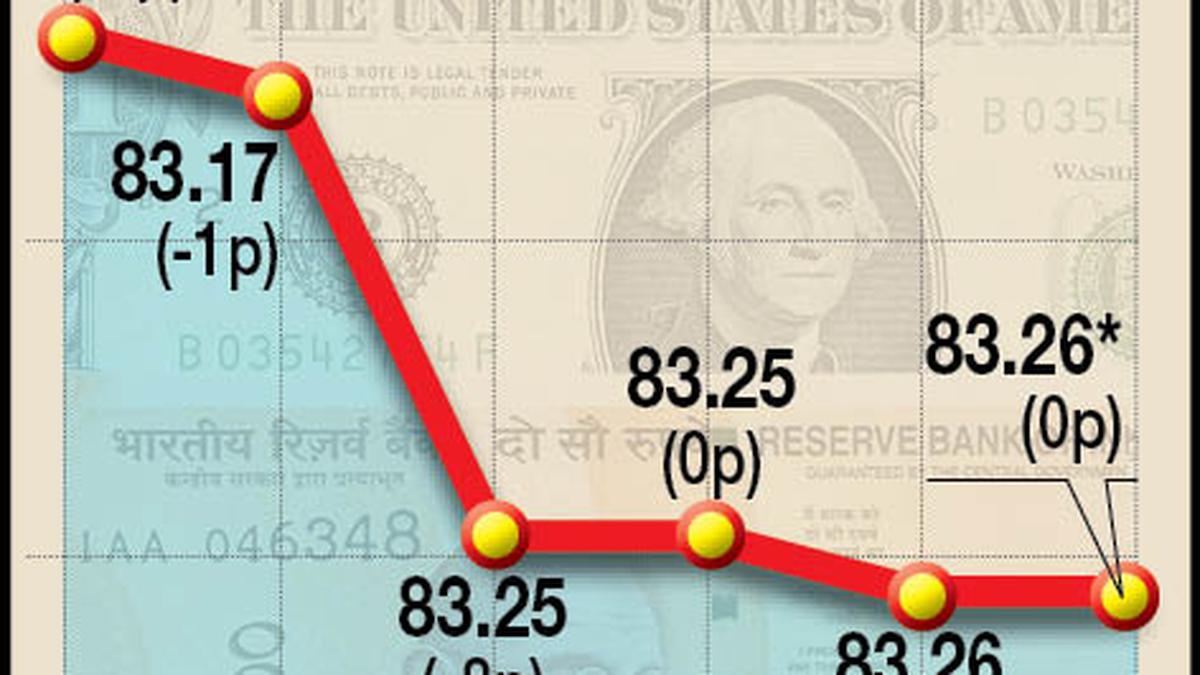

The rupee continued its gaining momentum for the second consecutive day and appreciated 7 paise to settle at 83.18 (provisional) against the U.S. dollar on October 11 amid robust buying in domestic equities and a weak American currency overseas.

However, unabated withdrawal of funds by foreign institutional investors weighed on the domestic currency, Forex analysts said.

At the interbank foreign exchange, the rupee opened strong at 83.20 and traded between the intra-day peak of 83.15 and the lowest level of 83.24 against the greenback. The local unit finally settled at 83.18 (provisional), registering a gain of 7 paise from its previous close.

On October 10, the rupee settled 3 paise higher at 83.25 against the U.S. dollar.

According to Anuj Choudhary, research analyst at Sharekhan by BNP Paribas, the rupee is expected to trade with a slight positive bias on the rise in risk appetite in global markets and softness in the U.S. dollar amid dovish comments by U.S. Federal Reserve officials. However, geopolitical uncertainty due to the ongoing Israel-Hamas conflict may cap a sharp upside.

“Any upside reversal in crude oil prices and FII outflows may also weigh on the rupee at higher levels. Traders may remain cautious ahead of PPI data and FOMC minutes from the U.S. today and inflation data from India and the U.S. later this week. USD-INR spot price is expected to trade in a range of ₹82.80 to ₹83.50,” Mr. Choudhary said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.09% lower at 105.73.

Brent crude futures, the global oil benchmark, declined 0.65% to $87.08 per barrel.

On the domestic equity market front, the BSE Sensex closed 393.69 points or 0.60% higher at 66,473.05. The broader NSE Nifty climbed 121.50 points or 0.62% to 19,811.35.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Tuesday as they offloaded shares worth ₹1,005.49 crore, as per exchange data.