Non-bank lender Bajaj Finance is acquiring 26% equity stake in Hyderabad-based fintech solutions provider Pennant Technologies for ₹267.50 crore.

It is aimed at strengthening the company’s technology roadmap, Bajaj Finance said in a filing on October 17 ahead of its Board meeting for the September quarter results.

A binding term sheet was signed for the acquisition on October 16. As part of the all cash transaction, which is expected to be completed before December 30, Bajaj intends to acquire a little more than 5.71 lakh Compulsorily Convertible Preference Shares (Series A CCPS) of face value of ₹100 each and more than 4.22 lakh equity shares from Pennant promoters and existing shareholders.

Set up in 2005, Pennant provides technology services and software products for the banking and financial services industry. It had reported ₹74.28 crore turnover in 2022-23 as against ₹52.07 crore in the previous fiscal.

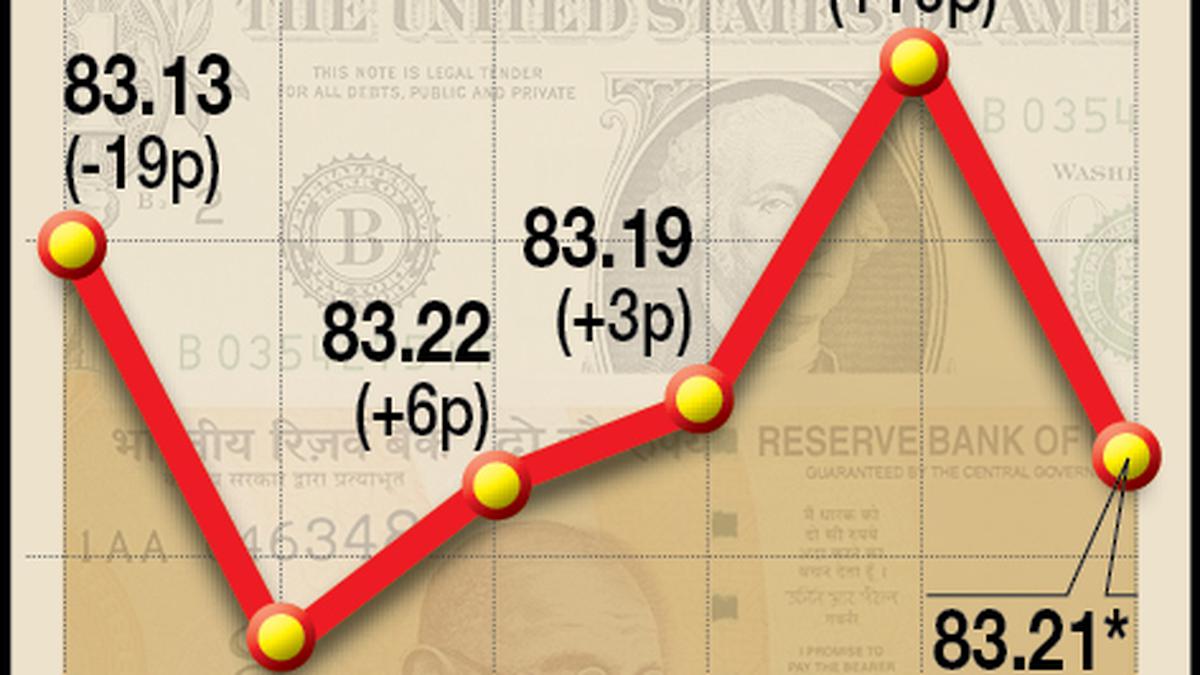

Announcing opening of its new, 20,000 sqft corporate office in Hyderabad, to accommodate 220 employees, in March 2022, the senior leadership of Pennant had said the company has been growing continuously and delivering technology solutions to address transformational needs of the global banking and financial services industry. Over the years, it has partnered with more than 45 banks and financial institutions across Middle East, Europe and India and delivered business driven software solutions covering all facets of the banking and financial services industry. Bajaj Finance shares had gained more than 1% on BSE around 11.30 a.m. at ₹8,113.80 each.