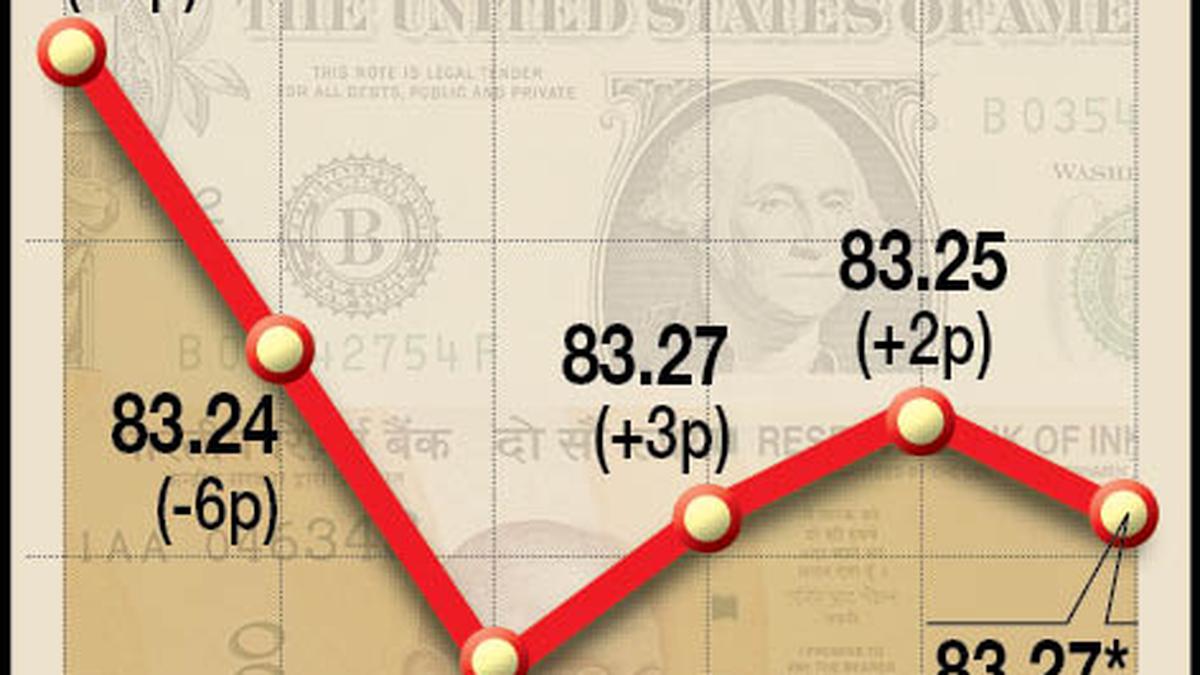

The rupee settled 2 paise lower at 83.27 (provisional) against the U.S. dollar on Wednesday, tracking negative cues from domestic equity markets amid surging crude oil prices overseas.

However, fresh foreign capital inflows and a weak greenback against major rivals overseas favoured the rupee and restricted the loss, forex traders said.

At the interbank foreign exchange, the domestic unit opened at 83.24 against the dollar and traded in a narrow range of 83.23 to 83.27. It finally settled at 83.27 (provisional) against the greenback, registering a loss of 2 paise over its previous close.

On Tuesday, the rupee settled at 83.25 against the U.S. dollar.

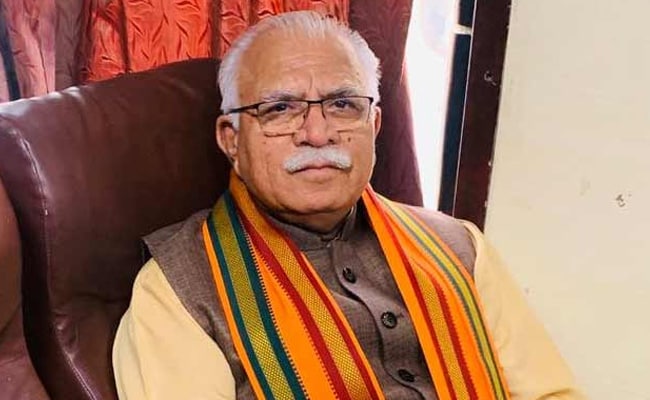

Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas, said the rupee declined amid weak domestic markets and a jump in crude oil prices.

“However, the softening of the U.S. dollar cushioned the downside. The U.S. dollar softened as U.S. President Joe Biden landed in Israel raising expectations that the Hamas-Israel conflict may get contained.

“This waned safe-haven demand for the U.S. dollar. Dovish comments from U.S. Federal Reserve officials also weighed on the greenback. Economic data from the U.S. on Tuesday topped forecasts as retail sales and industrial production were better than market expectations,” he said.

Mr. Choudhary also said that traders may take cues from housing market data and the U.S. Beige Book, a report based on the analysis of Federal Reserve officials.

“USD-INR spot price is expected to trade in a range of ₹82.90 to ₹83.60.”

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.05% to 106.20.

Brent crude futures, the global oil benchmark, witnessed a sharp rise of 3.05% to $89.30 per barrel.

On the domestic equity market front, the BSE Sensex closed 551.07 points or 0.83% lower at 65,877.02. The broader NSE Nifty declined 140.40 points or 0.71% to 19,671.10.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Tuesday as they purchased shares worth ₹263.68 crore, according to exchange data.