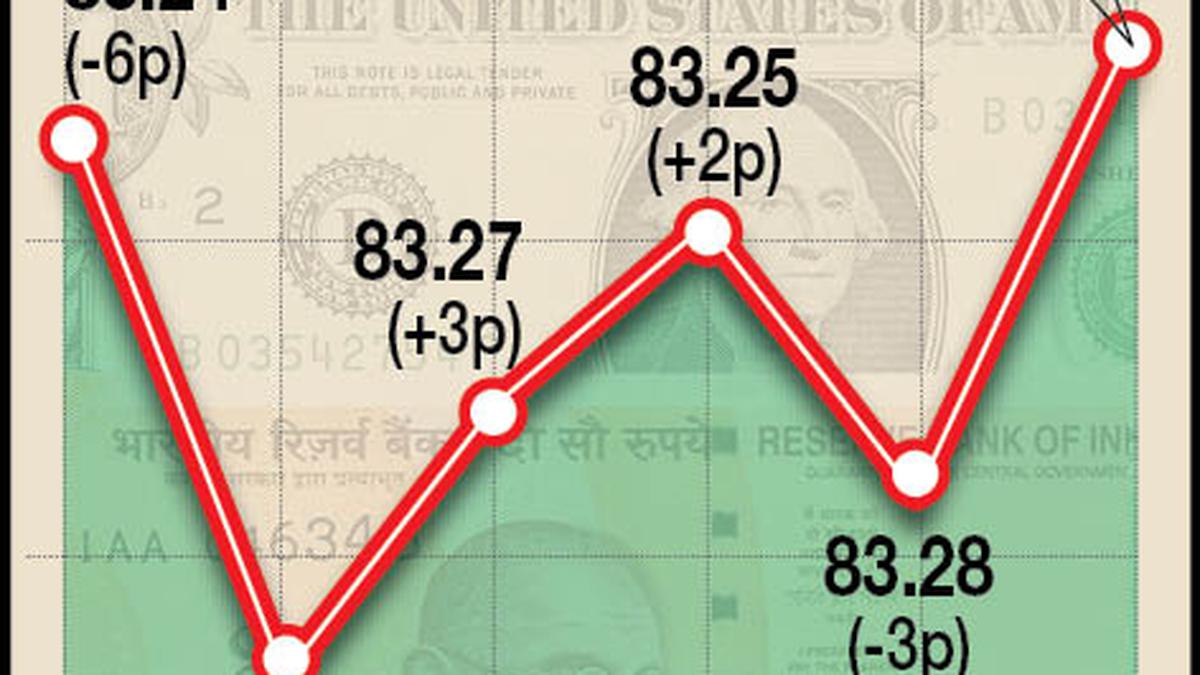

The rupee traded in a narrow range to settle 5 paise higher at 83.23 (provisional) against the U.S. dollar on Thursday, tracking softening crude prices in the international markets amid lingering geopolitical uncertainties. However, foreign fund outflows, a weak greenback overseas and a negative trend in domestic equities weighed on investor sentiments, forex traders said.

At the interbank foreign exchange market, the local unit opened at 83.26 against the U.S. currency and witnessed a high of 83.23 and a low of 83.28 during intra-day trade.

The local unit settled at 83.23 (provisional), registering a gain of 5 paise over its previous close.

The rupee declined on Thursday pressurised by a weak tone in the domestic markets and a rise in U.S. Dollar. FII selling also weighed on the domestic currency, said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.05% to 106.61.

Global oil benchmark Brent crude futures fell 1.92% to $89.74 per barrel.

“We expect the rupee to trade with a slight negative bias as risk aversion in the global markets amid rising geopolitical uncertainty in the Middle East may put pressure on Rupee,” Mr. Choudhary said.

However, any diplomatic efforts to contain the conflict in the Middle East may support the rupee at lower levels. Traders may take cues from weekly unemployment claims and existing home sales data from the U.S.

“Investors may remain cautious ahead of U.S. Federal Reserve Chair, Jerome Powell’s speech for some cues over monetary policy trajectory. USD/INR spot price is expected to trade in a range of ₹83 to ₹83.60,” he said.

On the domestic equity market front, Sensex fell 247.78 points or 0.38% to settle at 65,629.24 points. The Nifty declined 46.40 points or 0.24% to 19,624.70 points.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Wednesday as they sold shares worth ₹1,831.84 crore, according to exchange data.