Jayanth R. Varma said while external demand is weak due to the sluggishness in the world economy, the revival in private capital expenditure is still too tentative and muted.

RBI MPC member Jayanth R. Varma on October 24 said that he is ‘little more’ optimistic about India’s economic growth than a few months ago, though concerns remain as the country is now ‘disproportionately’ dependent on household spending with other components of demand encountering headwinds.

Mr. Varma further said that India should be willing to accept inflation between 4% and 5% for several quarters as the price of avoiding a growth shock.

“I am a little more optimistic about growth than I was 2-4 months ago. My cautious optimism stems from improved consumer confidence and various indicators that point to the continuation of the growth momentum,” he told PTI in a telephonic interview.

While keeping the global growth projection for FY24 unchanged at 3%, the International Monetary Fund (IMF) recently revised its growth projection for India upwards by 20 basis points to 6.3% in October.

“However, the outlook remains fragile because demand is now disproportionately dependent on household spending with other components of demand encountering headwinds,” the eminent economist emphasised.

Explaining further, the Monetary Policy Committee (MPC) member said while external demand is weak due to the sluggishness in the world economy, the revival in private capital expenditure is still too tentative and muted.

“Fiscal consolidation amounts to a withdrawal of the pandemic era government spending stimulus,” Varma, currently a professor at the Indian Institute of Management, Ahmedabad noted.

India’s GDP growth in 2022-23 was 7.2%, lower than 9.1% in 2021-22.

According to the Reserve Bank of India’s projections, India’s GDP is likely to grow at 6.5% in the current fiscal year.

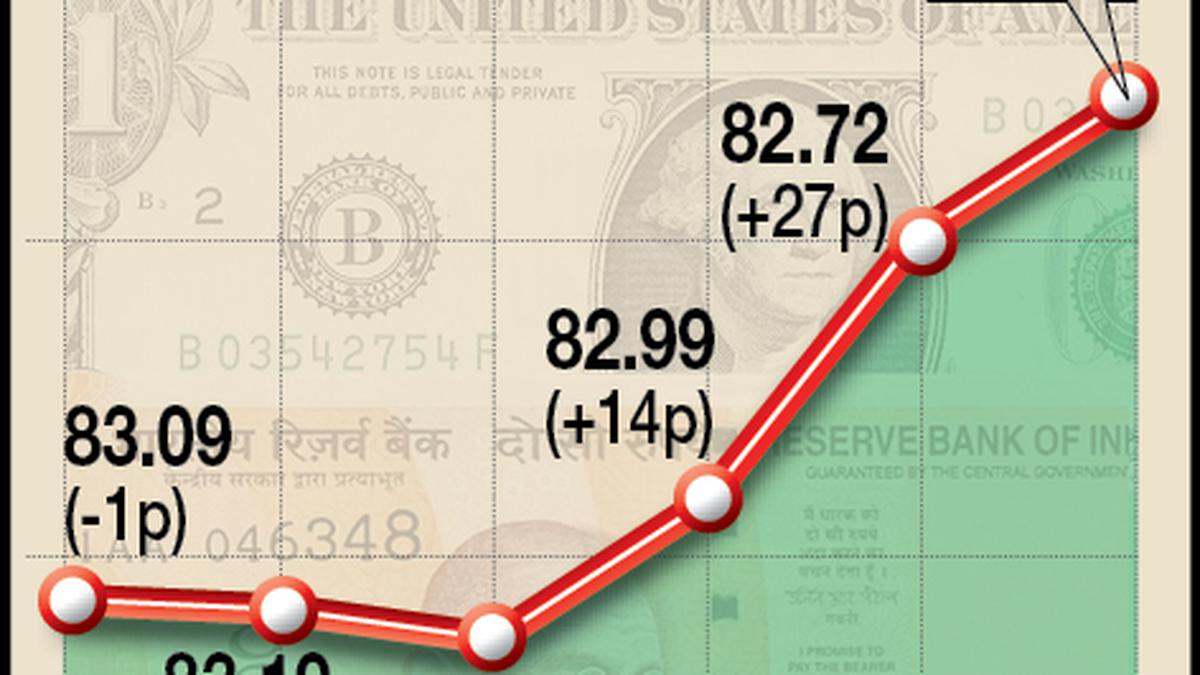

Asked when inflation will fall back to the RBI’s target of 4%, Mr. Varma said August inflation was high, but September inflation is within the band and October inflation is also expected to be low.

Pointing out that India has been experiencing a lot of volatility in commodity and food prices over the last couple of years, he said in this context, a sharp rise or drop in inflation in one or two months does not mean anything.

“I am confident that we will achieve this goal, but I think it will take a few more quarters… We should be willing to accept inflation between 4% and 5% for several quarters as the price of avoiding a growth shock,” Mr. Varma said.

The eminent economist noted that a more rapid pace of reduction could impose an intolerable growth sacrifice.

Annual retail inflation, called CPI or consumer price index, rose 5.02 per cent in September from 6.83% in the previous month on the back of softer vegetable prices.

Recently, Reserve Bank of India Governor Shaktikanta Das has said that the fundamental goal of the monetary policy is to align inflation with the 4% target and anchor inflation expectations.

RBI MPC in its last meeting earlier in the month, decided to keep the benchmark lending rate at 6.5 per cent, for the fourth time in a row, in a bid to keep retail inflation under check.

Responding to a question on the implication of high crude oil prices on the government’s subsidy figure and inflation, Mr. Varma stressed that there is no question that the conflicts in the Middle East pose risks to the world economy.

“What I find reassuring is that oil prices have remained range-bound in the face of these conflicts,” he said, adding this is in his view suggestive of depressed global demand putting a lid on prices.

Mr. Varma, however, warned that of course, a bigger flare up in the region that takes us back to 1973 would be a very different situation, but as of now there is ground for guarded optimism.

“These conflicts would slow the fall in inflation but would not reverse its decline,” he opined. The Israeli military has been carrying out retaliatory air strikes on Gaza following the unprecedented attack on Israel on October 7 by Hamas.