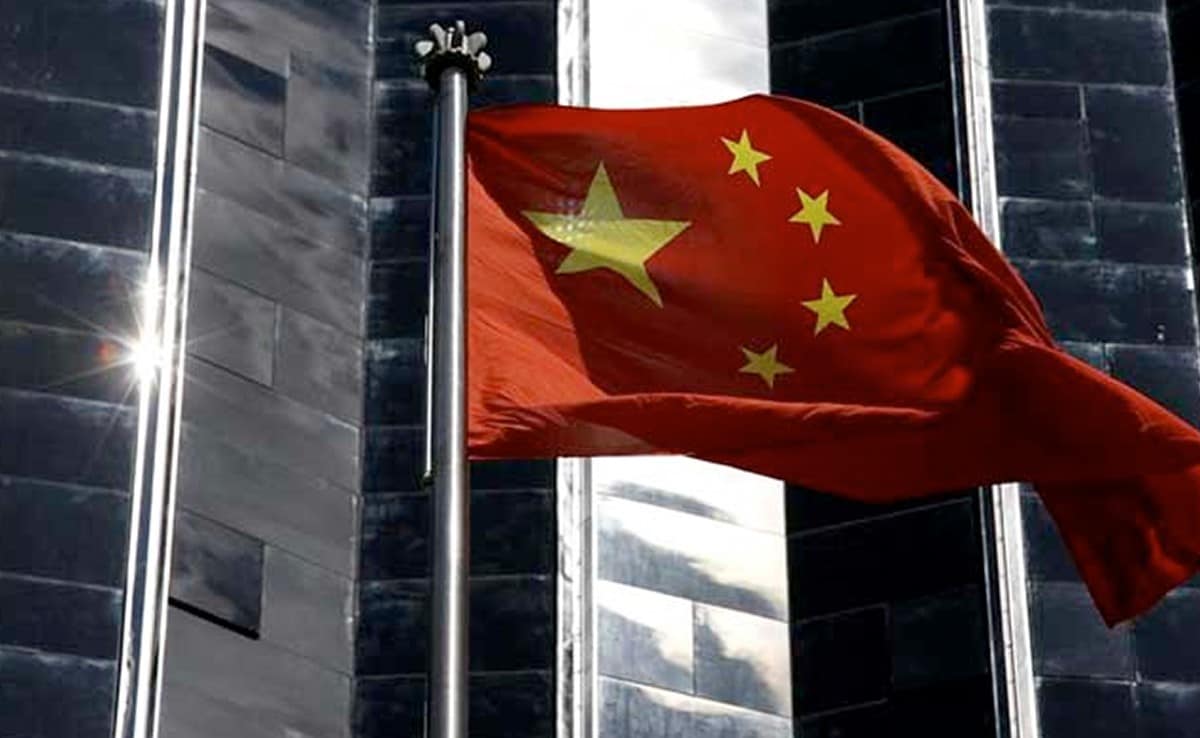

A file photo of BSE building in Mumbai.

| Photo Credit: Reuters

Equity benchmark indices snapped two days of rally to settle lower on October 31 amid unabated foreign fund outflows and escalating tensions in the Middle East.

Besides, investors were cautious ahead of the US Federal Reserve’s interest rate decision.

The 30-share BSE Sensex declined 237.72 points or 0.37% to settle at 63,874.93. During the day, it fell 300.12 points or 0.46% to 63,812.53.

The Nifty dipped 61.30 points or 0.32% to 19,079.60.

Among the Sensex firms, Mahindra & Mahindra, Bharti Airtel, ICICI Bank, IndusInd Bank, Reliance Industries, Axis Bank and HDFC Bank were among the major laggards.

Titan, Kotak Mahindra Bank, Asian Paints, HCL Technologies, Tech Mahindra, NTPC, Nestle and Power Grid were the major gainers.

In Asian markets, Seoul, Shanghai and Hong Kong settled lower while Tokyo ended in the green.

European markets were trading in the positive territory. The US markets ended significantly higher on Monday.

Global oil benchmark Brent crude climbed 0.93 per cent to $88.31 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,761.86 crore on Monday, according to exchange data.

The BSE benchmark jumped 329.85 points or 0.52% to settle at 64,112.65 on Monday. The Nifty advanced 93.65 points or 0.49% to 19,140.90.