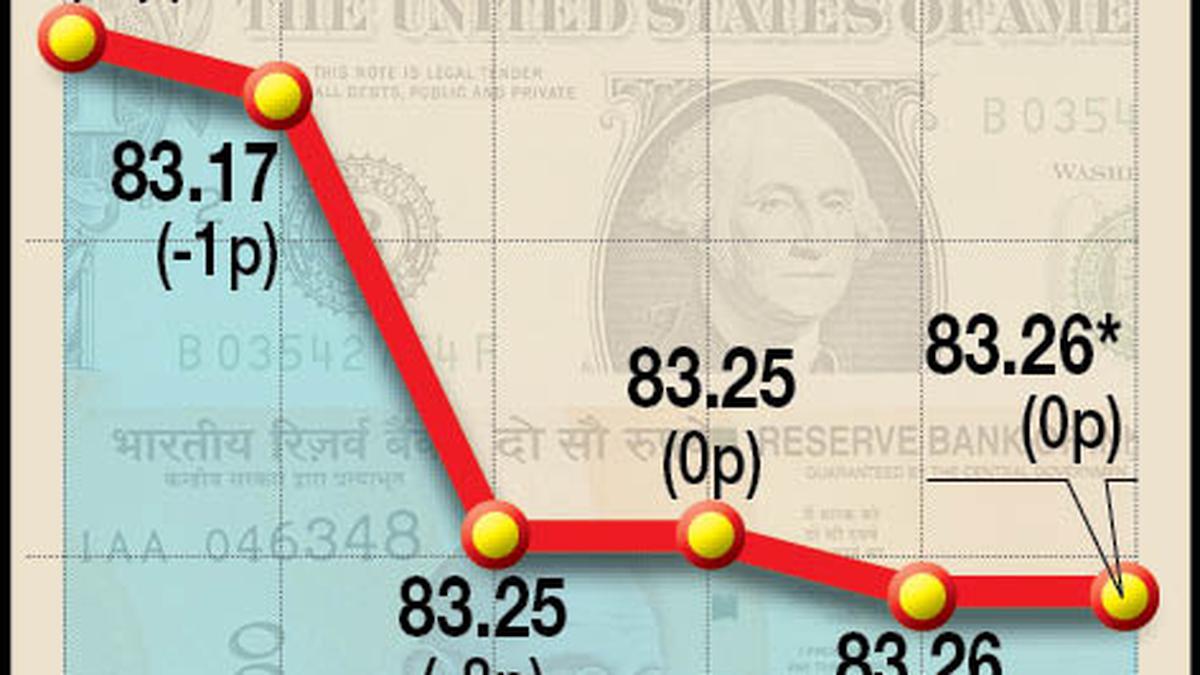

The rupee depreciated 9 paise to close at an all-time low of 83.33 (provisional) against the U.S. dollar on Wednesday, tracking a strong greenback against major rivals overseas and unabated foreign capital outflows.

Besides, a negative trend in domestic equities and elevated crude oil prices amid geopolitical uncertainty in the Middle East weighed on investor sentiments, according to forex traders.

At the interbank foreign exchange, the rupee opened at 83.26 against the dollar. During the trading session, it touched an intra-day low of 83.35 and a high of 83.26 against the American currency.

The local unit finally settled at its lifetime low of 83.33 (provisional), lower by 9 paise against its previous close.

On Tuesday, the rupee settled at 83.24 against the American currency.

“We expect the rupee to trade with a slight negative bias on the strong Dollar amid geopolitical uncertainty in the Middle East. Weak tone in domestic markets may also weigh on the rupee.”

“Traders may take cues from manufacturing PMI from India and ADP non-farm employment, JOLTS job opening and ISM manufacturing PMI data from the US. Investors may remain cautious ahead of the FOMC meeting tonight. USD/INR spot price is expected to trade in a range of ₹83-83.60,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.20% higher at 106.87.

Global oil benchmark Brent crude futures advanced 1.34% to $86.16 per barrel.

On the domestic equity market front, BSE Sensex was trading 283.60 points or 0.44% lower at 63,591.33, while the broader NSE Nifty declined 90.45 points or 0.47% to 18,989.15.

Forex traders said disappointing macroeconomic data from India and FII outflows further pressurised the rupee.

On the domestic macroeconomic data, the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) slipped from 57.5 in September to 55.5 in October, the slowest rate of expansion since February.

Foreign institutional investors were net sellers in the capital market on Tuesday as they offloaded shares worth ₹696.02 crore, according to exchange data.