Image used for representational purpose only.

| Photo Credit: Reuters

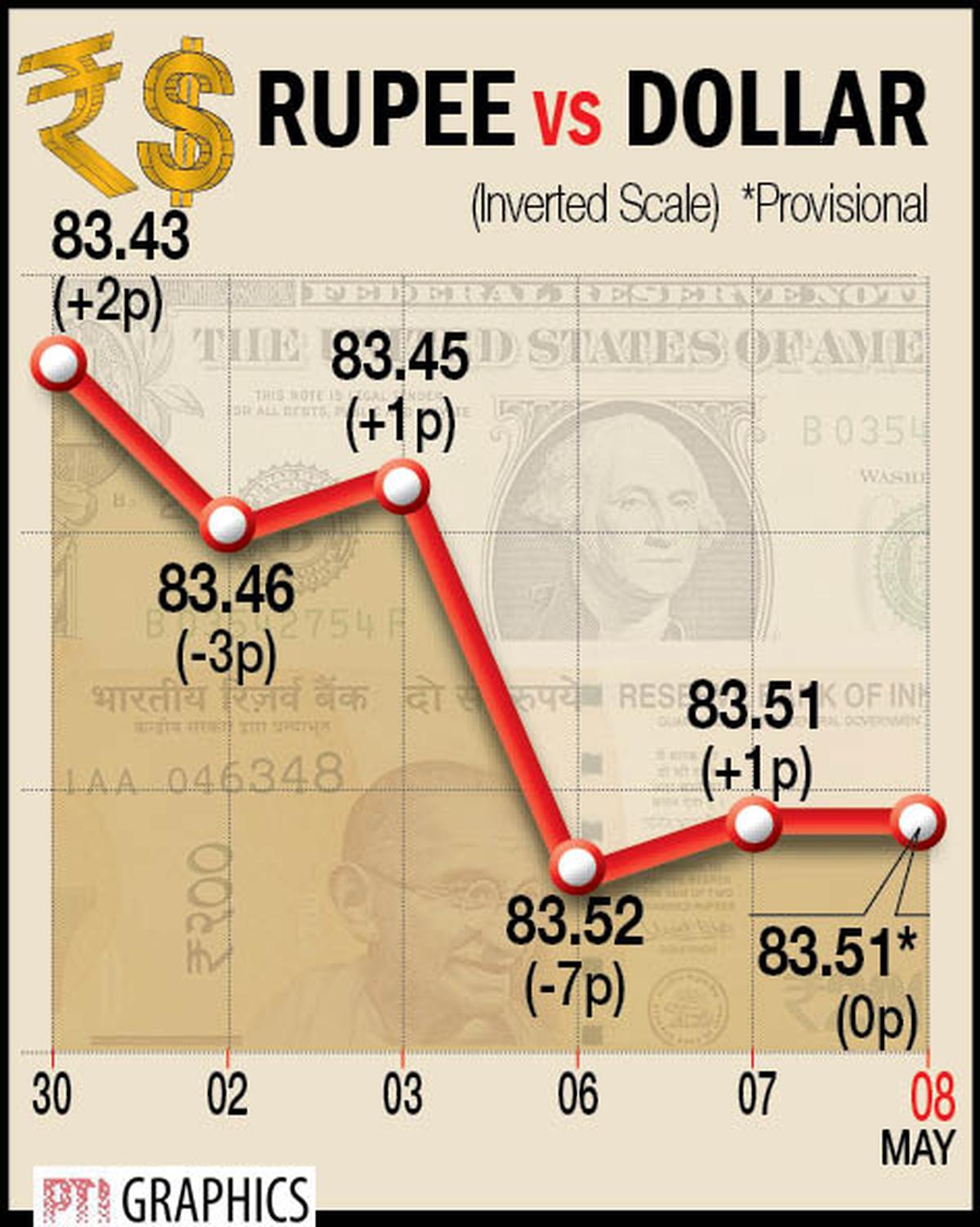

The rupee appreciated by 9 paise to 83.19 against the U.S. dollar in early trade on November 2, tracking its Asian peers as risk-on sentiments prevailed in the market as the U.S. Fed was a bit dovish in its policy meeting.

A weak U.S. dollar overseas and positive domestic equities supported the local unit in early trade, forex traders said.

The U.S. Fed kept interest rates on hold, and its chairman looked content with the economy’s soft landing. Following the decision, the dollar index softened, and the 10-year bond yield fell to 4.70.

At the interbank foreign exchange, the domestic unit opened at 83.23 against the dollar and then touched an early high of 83.19, registering a gain of 9 paise over its previous close.

On Wednesday, the rupee settled at 83.28 against the U.S. dollar. The local unit hit all-time low level of 83.35 against the American currency during intra-day.

“Asian currencies all gained against the dollar after the dovish FED as risk-on sentiments prevailed in the market. Brent oil rose slightly to $85.45 per barrel,” said Anil Kumar Bhansali, Head of Treasury and Executive Director of Finrex Treasury Advisors LLP.

Mr. Bhansali noted that the rupee made a new closing low of 83.29/30 on demand from importers, FPI outflows and ECB redemptions.

“However, today’s opening is higher at 83.22 as FED was a bit dovish in its policy meeting,” he said.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.51% lower at 106.34.

Brent crude futures, the global oil benchmark, rose 1.05% to $85.52 per barrel.

In the domestic equity market, the 30-share BSE Sensex was trading 568.23 points or 0.89% higher at 64,159.56. The broader NSE Nifty advanced 155.80 points or 0.82% to 19,144.95.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Wednesday as they sold shares worth ₹1,816.91 crore, according to exchange data.