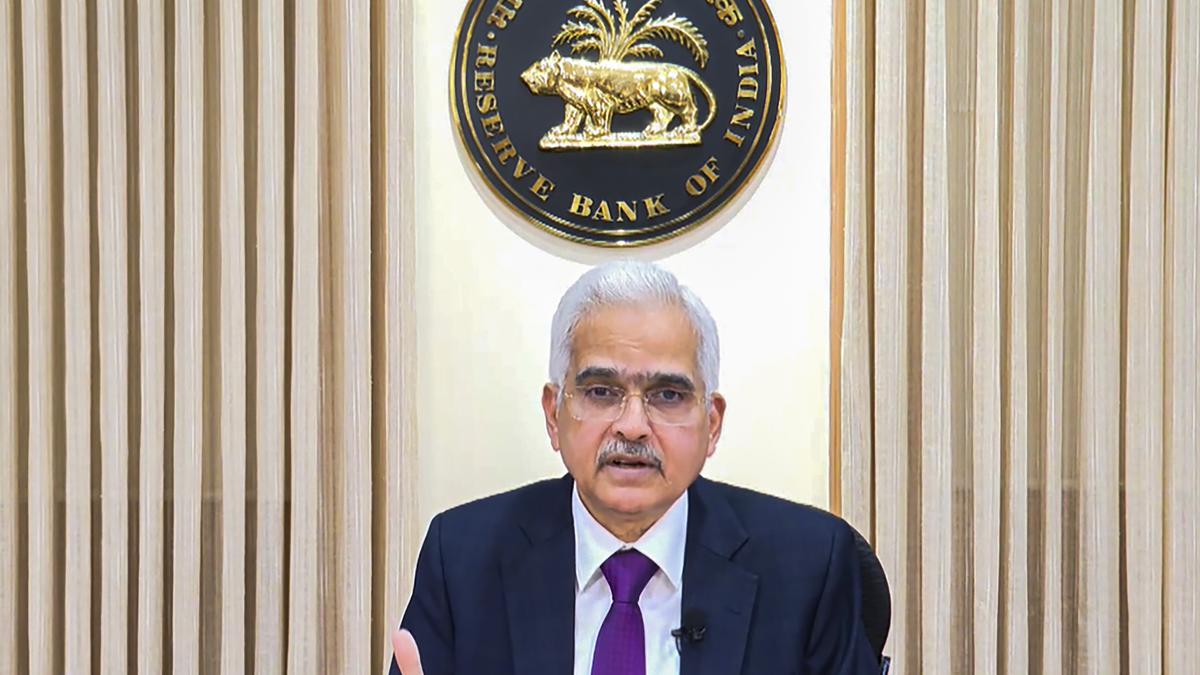

The Monetary Policy Committee (MPC) on April 5 decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50%. This is the 7th time that the rates have been kept on hold.

The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

Also read: RBI Monetary Policy live updates – April 5

“These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth,” RBI governor Shaktikanta Das announced after the MPC meeting.

Stating that the domestic economy was experiencing strong momentum, he said as per the second advance estimates (SAE), real gross domestic product (GDP) expanded at 7.6% in 2023-24 on the back of buoyant domestic demand.

“Real GDP increased by 8.4% in Q3, with strong investment activity and a lower drag from net external demand. On the supply side, gross value added recorded a growth of 6.9 per cent in 2023-24, driven by manufacturing and construction activity,” he said.

Looking ahead, Mr. Das said, an expected normal south-west monsoon should support agricultural activity. “Manufacturing is expected to maintain its momentum on the back of sustained profitability. Services activity is likely to grow above the pre-pandemic trend,” he said.

“Private consumption should gain steam with further pick-up in rural activity and steady urban demand. A rise in discretionary spending expected by urban households, as per the Reserve Bank’s consumer survey, and improving income levels augur well for the strengthening of private consumption,” he added.

“The prospects of fixed investment remain bright with business optimism, healthy corporate and bank balance sheets, robust government capital expenditure and signs of upturn in the private capex cycle,” he further said. The Governor said headwinds from geopolitical tensions, volatility in international financial markets, geo-economic fragmentation, rising Red Sea disruptions, and extreme weather events, however, pose risks to the outlook.

“Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0% with Q1 at 7.1%; Q2 at 6.9%; Q3 at 7.0%; and Q4 at 7.0%. The risks are evenly balanced.”

On inflation the Governor said “Two years ago, around this time, when CPI inflation had peaked at 7.8% in April 2022, the elephant in the room was inflation. The elephant has now gone out for a walk and appears to be returning to the forest. We would like the elephant to return to the forest and remain there on a durable basis.”

“In other words, it is essential, in the best interest of the economy, that CPI inflation continues to moderate and aligns to the target on a durable basis. Till this is achieved, our task remains unfinished,” he added

He said the headline softened to 5.1% during January-February 2024, from 5.7% in December. After correcting in January, food inflation edged up to 7.8% in February primarily driven by vegetables, eggs, meat and fish.

Fuel prices remained in deflation for the sixth consecutive month in February. CPI core (CPI excluding food and fuel) disinflation took it down to 3.4% in February — this was one of the lowest in the current CPI series, with both goods and services components registering a fall in inflation, he said. He said going ahead, food price uncertainties would continue to weigh on the inflation outlook. An expected record rabi wheat production in 2023-24, however, will help contain cereal prices. Early indications of a normal monsoon also augur well for the kharif season.

“On the other hand, the increasing incidence of climate shocks remains a key upside risk to food prices. Low reservoir levels, especially in the southern states and outlook of above normal temperatures during April-June, also pose concern. Tight demand supply conditions in certain pulses and the prices of key vegetables need close monitoring,” he said.

“Fuel price deflation is likely to deepen in the near term following the recent cut in LPG prices. After witnessing sustained moderation, cost push pressures faced by firms are showing upward bias. The recent firming up of international crude oil prices warrants close monitoring. Geo-political tensions and volatility in financial markets also pose risks to the inflation outlook,” he added.

“Taking into account these factors and assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5% with Q1 at 4.9%; Q2 at 3.8%; Q3 at 4.6%; and Q4 at 4.5%. The risks are evenly balanced.

The MPC also noted that domestic economic activity remains resilient, backed by strong investment demand and upbeat business and consumer sentiments. Headline inflation has come off the December peak; however, food price pressures have been interrupting the ongoing disinflation process, posing challenges for the final descent of inflation to the target. Unpredictable supply side shocks from adverse climate events and their impact on agricultural production as also geo-political tensions and spillovers to trade and commodity markets add uncertainties to the outlook, Mr Das said.

“As the path of disinflation needs to be sustained till inflation reaches the 4% target on a durable basis, the MPC decided to keep the policy repo rate unchanged at 6.50% in this meeting,” he added.

Stating that monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission, he said the MPC would remain resolute in its commitment to aligning inflation to the target.

“The MPC believes that durable price stability would set strong foundations for a period of high growth. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth,” he said.