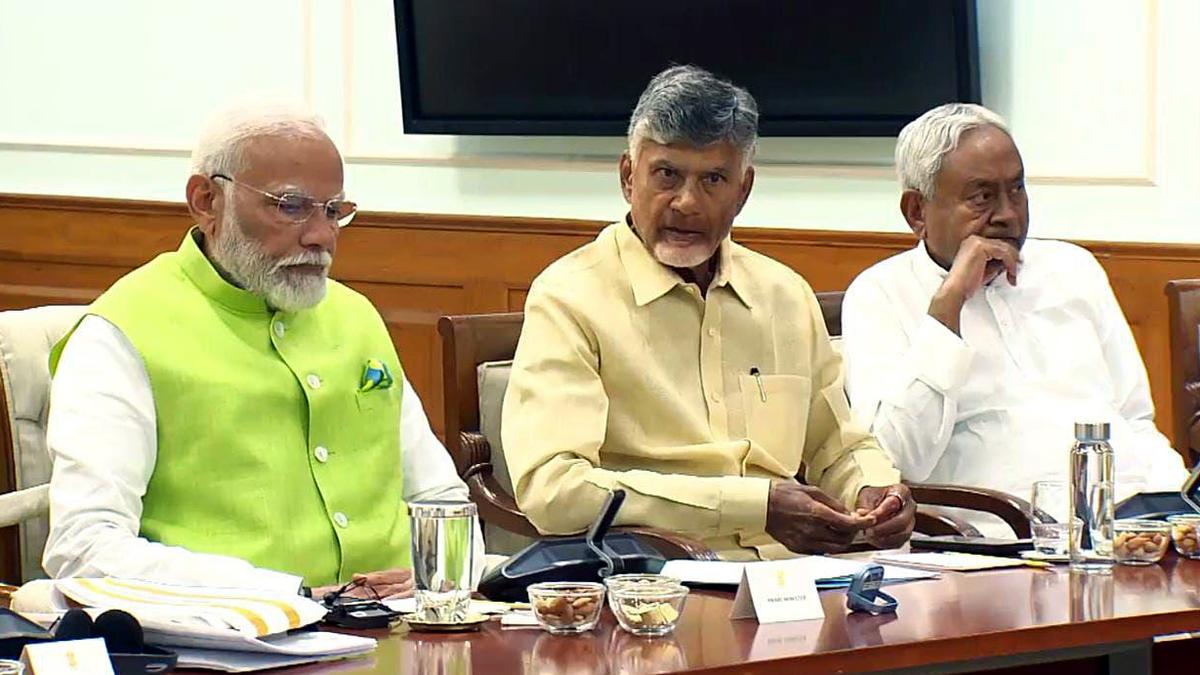

In the run-up to the Union Budget, Nitish Kumar and Chandrababu Naidu, the Chief Ministers of Bihar and Andhra Pradesh, respectively, who are in a position to decide the political fate of the National Democratic Alliance (NDA) government at the Centre, have demanded special financial packages for their respective States. These packages could potentially increase the fiscal burden on the Centre and also on other States. Should States get special packages outside Finance Commission allocations? Arun Kumar and Pinaki Chakraborty discuss the question in a conversation moderated by Prashanth Perumal J. Edited excerpts:

What is the basis on which the Finance Commission determines how much money is allocated to different States? Do you think there is a case for States such as Bihar and Andhra Pradesh to receive funds beyond what is being allocated to them through the Finance Commission?

Arun Kumar: The last Finance Commission had said that States should be given 41% of the divisible tax pool. Within that 41%, what does each State get? For that, there is a formula which is based on income, population, the area, forests and ecology, demographic performance, etc. If we look at the 15th Finance Commission, Uttar Pradesh and Bihar in 2020-21 got the largest amount of funds and Karnataka and Kerala saw the largest decrease in the share of funds. So, in other words, the criteria that the Finance Commission use can change the amount of funds going to different States.

Comment | The problem of special packages

Apart from the Finance Commission devolution, which is statutory, how the remaining amount is spent is determined by the Centre, and that is where political determination comes in; States which are closer to the Centre get more funds. Andhra Pradesh and Bihar are part of the NDA and their support is critical to the government. So, I suppose they will be able to draw more funds.

On Special Category Status for Andhra Pradesh| Explained

Pinaki Chakraborty: As far as transfers by the Finance Commission are concerned, the scope for discretion is very limited. Other Central transfers are also determined by certain principles of distribution across States. We can debate those schemes, their designs, etc., but those are certainly not arbitrary. So, that is the overall framework of transfer.

When there is a specific demand by a specific State for higher transfer of resources for a specific purpose, constitutionally there is no bar on giving more money to that State. But generally, it is not done on a large scale because if that becomes the order of the day, fiscal prudence becomes a casualty. So, the possibility of large-scale discretionary transfers is limited.

Also read | Andhra Pradesh is in crisis, needs more than special category status: Chandrababu Naidu

Andhra Pradesh had a major fiscal shock after bifurcation and that was partly offset when the Finance Commission provided revenue deficit grants. Why Andhra Pradesh still requires Central support requires a careful analysis. But Bihar’s case is different. Bihar’s per capita development spending is less than 60% of the all-States average. So, Bihar has a serious fiscal capacity problem. This has not been fully offset by Finance Commission transfers or additional Central transfers.

What is the relationship between additional Central aid and the economic performance of States? Does the allocation of more funds to a certain State boost its long-term economic performance?

Arun Kumar: There are several factors. The public and private sector together determine the development of a State. But with all other things remaining the same, higher allocations from the Centre to a State would boost the growth of that State. The major problem is the issue of governance — how well is the State governed and how well are the resources that are received by the State spent on development. Poorer States tend to have a greater amount of leakage of funds. But more importantly, the credit-deposit ratio of Bihar is much lower than the all-India average. This means that a large part of Bihar’s savings is leaking out of the State to other States. So, even if you allocate more funds from the Centre, the leakage may be greater than the additional resources they get.

Also read | What is the special category status?

Pinaki Chakraborty: If we look at revenue sharing, the part which is not within the purview of the Finance Commission has increased and that is also why we see an increase in centrally sponsored schemes. So, there is a larger political economy question which needs to be discussed. When we talk about resource flow to the richer regions of the country, it is much, much higher than the resource flow to the poorer regions of the country. This cannot be explained by governance differences alone. If there is a problem of resources, where a State is spending only 50% of the all-States average as public expenditure, this can’t just be explained by differences in governance and quality of expenditure. We need to channelise more resources for higher capital investment in the poorer regions of the country for balanced regional development.

By taking away from States the power to tax their citizens, has GST (Goods and Services Tax) exacerbated competition among States to get more funds from the Centre? We also see that there is no longer tax competition between the States after the centralisation of taxation under GST. Is that good or bad?

Pinaki Chakraborty: Because of this race to the bottom among States after liberalisation, States themselves decided to introduce a floor rate for sales tax in 2000-01. GST has resulted in significant loss of fiscal autonomy for the States because the States used to get two-thirds of their revenue from VAT (Value Added Tax). States also cannot set the tax rate, which is a key component of fiscal autonomy. So, there needs to be some flexibility somewhere within the GST structure so that the States don’t feel that they are not able to tax to provide public services. We should discuss what kind of GST flexibility can bring an element of fiscal autonomy without compromising on the fiscal harmonisation across States.

Arun Kumar: GST has damaged federalism because States are very diverse. The problems of Assam are not the same as those of Gujarat. The States have different sources of revenue and expenditure requirements. What we require in India, a very diverse country, is greater decentralisation and it is the only answer to the problems we face. Across the country, greater centralisation that has come in with GST is perhaps not good. What has happened with GST is that it has benefited the organised sector at the expense of the unorganised sector. Even though the unorganised sector has been kept out of GST, the organised sector is the one that has been rising and that is why you see that GST collections have been rising post-pandemic. This decline in the unorganised sector, which is concentrated in the backward States, means that backward States will under-perform. So, GST needs reform. I recommend that the tax be collected at the last point instead of at each intermediate stage, which creates a lot of complications. There is a lot of corruption associated with input credit, there are fake companies, etc. Trucks are stopped by the police and implementing agencies and money is extorted. So, the black economy continues to flourish. We need to collect a lot more from direct taxes and reduce collections from indirect taxes, which are having a negative effect on the backward States as compared to the advanced ones.

We see that States with political weight usually get more funds from the Centre at the cost of other States. So, how fair and objective is Central aid to states? Is there any way to stop politics from influencing how Central funds are allocated to the States?

Arun Kumar: Seventy per cent of the funds that the Centre spends is non-discretionary. But the remaining 30% are discretionary. The allocation of funds by the Centre to the States depends on politics or political considerations. Greater decentralisation and greater autonomy to the States is the only way to change that.

Pinaki Chakraborty: The real problem of discretion is that if the Centre decides to introduce a new scheme and says that 60% of it will be funded by the Centre and 40% will be funded by the States, it is actually tying up State resources. So, we need deliberations at the national level involving all the stakeholders to understand which schemes the Centre should intervene in, and which it should leave to the States. The 14th Finance Commission had given an important framework for this, recommending that the Centre should intervene in schemes where there are large externalities or national priorities involved. But if the Centre wants to run a primary health centre in a remote village, that is not going to help. So, I think this discussion about political alignment is only of marginal importance. What is really discretionary is the Centre’s complete autonomy in deciding which sector and where to spend.

Listen to the conversation in The Hindu Parley podcast

Arun Kumar former professor of economics at Jawaharlal Nehru University, New Delhi; Pinaki Chakraborty is Visiting Distinguished Professor, NIPFP