Photo used for representation purpose only.

| Photo Credit: Reuters

The privatisation of Air India leading to the transfer of its ownership by the government to Tata Sons in 2022 and the ensuing transformation plan being undertaken at the airline has triggered a strategic transformation in the country’s airline sector.

This was a remarkable milestone and the boldest reform since the second wave of liberalisation that commenced in financial year 2004. At the time of Air India’s acquisition, CAPA India had anticipated this would be a critical inflection point that would stabilise the airline system which, in turn, would have a positive impact on the entire value chain, possibly even beyond the borders of India.

Key developments in the sector

Let’s look at the key developments in the sector since 2022. Last year, Air India placed an order for a record 470 aircraft, with the option to add another 370 aircraft. The group has added 40 aircraft last year and is expecting to take delivery of five aircraft per month for the near to medium term.

Meanwhile, India’s largest airline IndiGo, which has a fleet of about 370 aircraft with more than 980 on order, continues to grow rapidly, despite supply-chain challenges that have fettered growth plans for airlines globally.

This means that the country’s airline fleet of almost 700 aircraft could double by the financial year 2030. It took the Indian industry about 90 years from the time of the first commercial flight to reach a fleet size of 700 aircraft. But the rate of growth is so strong that carriers could add a further 600-700 aircraft in just the next 5-7 years. But, do we have the ecosystem to support this rapid expansion?

We have a solid and aggressive airline system with the size, scale, aircraft orders and strategic intent to emerge as world-class operators. Air India’s investment of $6.5 billion in its business plan is a reflection of this. IndiGo reported record profitability of approximately $1 billion in FY2024, with another year of unprecedented results expected in FY2025.

Despite there being about 150 aircraft on the ground last year, domestic traffic grew by about 13% in FY2024 and international by 22%.

To support the appetite for travel as well as airline fleet expansion plans, the country also needs a solid airport infrastructure, which for the first time is ahead of demand and there is an investment pipeline of $11 billion at various stages of implementation. In the National Capital Region, we will have a world class airport infrastructure in a dual airport system where Delhi International Airport Limited will grow its capacity from 100 million and reach 130-140 million passengers per annum (PPA), which will be complemented by the greenfield Noida International Airport which is likely to open by April 2025, with eventual capacity for 70 million PPA. The Mumbai Metropolitan Region will similarly have a dual airport system within almost 12 months, which will eventually be able to handle about 145 million annual passengers. The Adani Group is also significantly expanding capacity at its six PPP non-metro airports of Lucknow, Jaipur Ahmedabad, Guwahati, Thiruvananthapuram and Mangaluru and the Airports Authority of India is investing $4 billion to significantly enhance non-metro capacity. Greenfield airports are also planned in Chennai and Pune.

Policy impetus

As far as policy impetus is concerned, given the rate of growth of the aviation industry in the country skills shortages could arise across the ecosystem, but particularly with respect to technical staff such as pilots and maintenance engineers and technicians. The shortage of pilots is a serious issue and is likely to become more acute, especially in light of the new duty and rest norms laid down by the DGCA for them, which could increase the number of pilots required by about 15%. Similarly, air-traffic controllers as well as security and safety personnel are inadequate relative to requirements. Therefore, the Budget must provide fiscal incentives for investment in skilling, training and education.

Beyond the Budget, the restructuring of Directorate General of Civil Aviation and the Bureau of Civil Aviation Security will be needed to address challenges emerging from disruption in technology and digitisation as well as environmental issues. Air Navigation Services should also be hived off from the AAI to enable corporatisation of air traffic control allowing for improved access to capital to invest in systems to cope with growing air traffic.

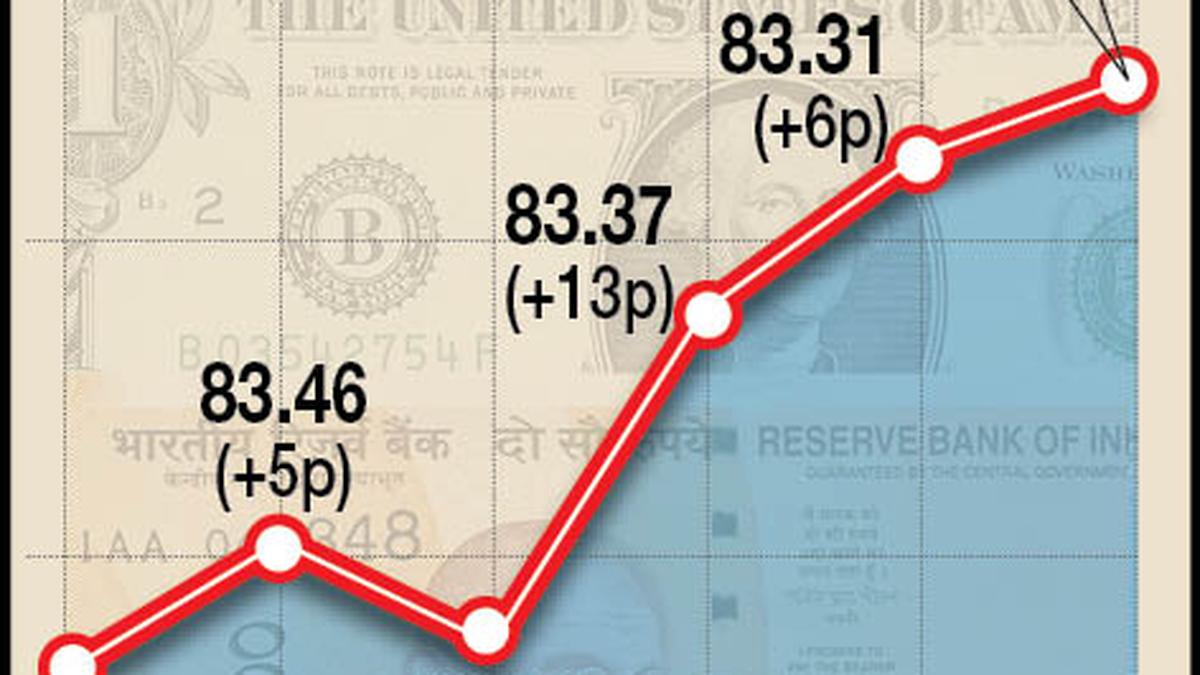

The Budget could also look at rationalising direct and indirect taxes, which today account for nearly 20% of an airline’s quarterly revenue such as through levies by States on aviation turbine fuel. The benefits of airport privatisation have been well demonstrated in the country through access to modern and efficient infrastructure as well as the economic development unleashed for the wider geographical region, and therefore the government must fast track the privatisation of 25 airports planned under the national monetisation plan.

(The writer is Chief Executive Officer and Director at CAPA India)