Adding heft: The tech platform will increase the utility and efficiency of CIR process.

Finance Minister Nirmala Sitharaman has proposed to set up an integrated technology platform to improve the outcomes under the Insolvency & Bankruptcy Code (IBC) for achieving transparency, consistency, timely settlement and better oversight of all resolution cases.

She also said that the government would set up additional National Company Law Tribunals (NCLTs) to expedite resolution of cases under the IBC.

“The IBC has resolved 1,000 companies resulting in direct recovery of ₹3.3 lakh crore to creditors. In addition, cases worth ₹10 lakh crore have been disposed off even before admission. We will set up additional tribunals to expedite the resolution of cases, with some dedicated to resolve cases exclusively under the Companies Act,” she said.

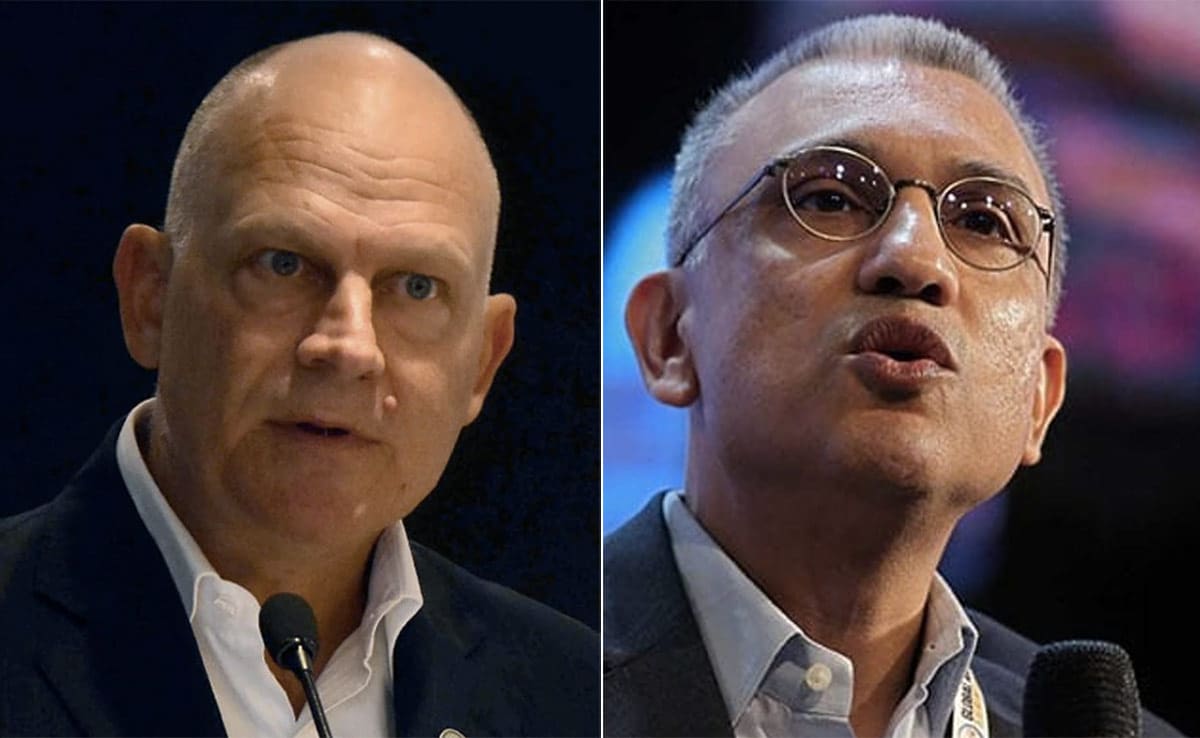

Commenting on this M. V. Rao, Chairman, Indian Banks’ Association (IBA) & Managing Director & CEO, Central Bank of India said” The measures to improve the outcomes under the IBC, extending the services of Centre for Processing Accelerated Corporate Exit voluntary closure of LLPs, strengthening of National Company Law Tribunals and establishing more debt recovery tribunals are positive for the banking sector as it enhances the speed of the recovery processes in the system.”

“The integration of all pillars of IBC ecosystem through a tech platform will increase the utility and efficiency of CIR process. The improvement in legislative framework and increased strength of tribunals is expected to bring more efficiency in the process,” said Anoop Rawat, Partner, Shardul Amarchand Mangaldas & Co.

“The technological integration will also help in identifying source of delay and corrective measures needed for improving efficiency,” he added.