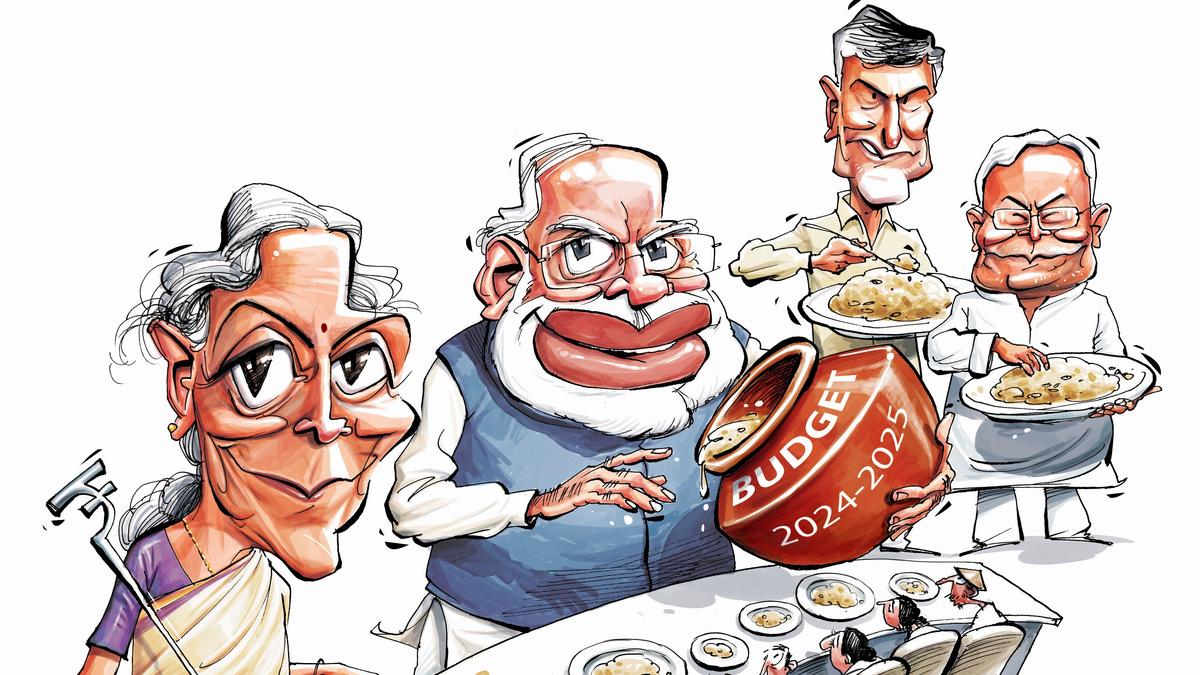

Presenting her seventh Union Budget and the first after this year’s Lok Sabha election, Finance Minister Nirmala Sitharaman on July 23 unveiled a flurry of measures aimed at fixing the woes of unemployed youth, small businesses, and the middle class, and sought to strengthen the ruling NDA coalition’s bonds with support for multiple investment projects in Bihar and Andhra Pradesh.

Ms. Sitharaman proposed income tax rate cuts worth up to ₹17,500 a year, putting an extra ₹1,458 a month in the hands of those earning upto ₹12 lakh a year, and hiked standard deductions for salaried taxpayers and pensioners by ₹25,000 and ₹10,000, respectively. She also promised to spend ₹2 lakh crore over five years on five schemes which are part of what she called “the Prime Minister’s package”, aimed at spurring jobs and imparting skills to 4.1 crore youth.

Changing lanes

This marked a shift in strategy, or rather a frenetic changing of lanes ahead of a roundabout as drivers in the capital are prone to do, from the previous government’s preferred reliance on letting multiplier and trickle-down effects work while avoiding direct handouts to such sections of society. A similar lane change was last seen when Ms. Sitharaman’s predecessor, the late Arun Jaitley, presented his third Budget, for 2016-17.

Seeking to shed the “suit-boot sarkar” label used by the Opposition at the time, Mr. Jaitley had dedicated that Budget to the farmers, the poor, and vulnerable sections of society and switched his focus to the rural economy and job creation. The trigger for the shift, this time, could be the BJP’s electoral reverses after a decade of outright majority in Parliament, preceded by revelations such as big businesses’ electoral bond purchases.

Jobs, jobs, jobs

At a briefing after her roughly-90 minute speech, which appeared to acknowledge and begin addressing the perceived disenchantment among specific voter groups like the young, the salaried class, farmers, and small entrepreneurs, Ms. Sitharaman made it clear that the overarching theme of Budget 2024-25 was ‘EMPLOYMENT’. Used as an acronym, the theme was spelt out — Employment and Education; Micro, Small and Medium Enterprises (MSMEs); Productivity; Land; Opportunities; Youth; Middle Class; Energy Security; New Generation Reforms; and Technology.

Her speech referred to ‘employment’ 23 times, up sharply from three mentions of the word in the 2023-24 Budget, and seven (four of which were about past achievements rather than the future) in the Interim Budget presented this February. ‘Jobs’ featured four times in relation to new schemes, compared with just one mention in the pre-poll Interim Budget. Similarly, there were three references to the middle-class, from just one mention in the Interim Budget and two in 2023-24.

Shift in priorities

References to growth slipped to 10, from a combined 34 mentions in the last two Budget speeches. Mr. Jaitley’s third Budget had also slashed growth references, but the similarities with that speech don’t end there. While he had released a plan to ‘Transform India’ based on action points around nine pillars, Ms. Sitharaman on Tuesday laid out nine priorities for generating ample opportunities for all. Five of those are, in fact, similar to Mr. Jaitley’s list that led with the promise to double farmers’ incomes in five years. Ms. Sitharaman said that her first priority would be to raise productivity and resilience in agriculture, followed by employment and skilling, inclusive human resource development and social justice.

Infrastructure and next generation reforms also figure in the priorities, with the Minister promising more details about the latter through an economic policy framework to be formulated later, with a focus on fixing factors of productivity, including land, labour, capital, and entrepreneurship. She also announced a review of the Income Tax and Customs Acts, a simplification of Foreign Direct Investment (FDI) norms, and a financial sector vision document for five years.

Fiscal consolidation

While investors will need to wait for those details, the Finance Minister did provide some indirect support to private investments by accelerating the fiscal consolidation process, armed with a ₹2.1 lakh crore surprise dividend from the central bank. The fiscal deficit target for this year has been pegged at 4.9% of GDP from the 5.1% projected in the Interim Budget, and the 5.6% of GDP achieved last year. A reduction in the government’s market borrowings would facilitate a reduction in policy interest rates and encourage private investment, EY’s chief policy advisor D.K. Srivastava pointed out.

Among the PM’s employment package schemes is a plan to provide one year internships in 500 top companies to one crore youth over five years. It is not clear if this will subsume the Pradhan Mantri Kaushal Vikas Yojana 4.0 that was announced in the last Budget to “skill lakhs of youth within the next three years” with an on-the-job training component.

As is the case with many initiatives of this Budget, more details will emerge over time. But Ms. Sitharaman, who began her speech by thanking the people of India for re-electing a government led by Prime Minister Narendra Modi, will be hoping that the lens change reflected in the Budget’s focus areas will not be lost on voters gearing up to cast their ballots in the upcoming State Assembly elections.