At the interbank currency exchange, the domestic currency opened at 83.72, 1 paisa higher than the previous day’s close.

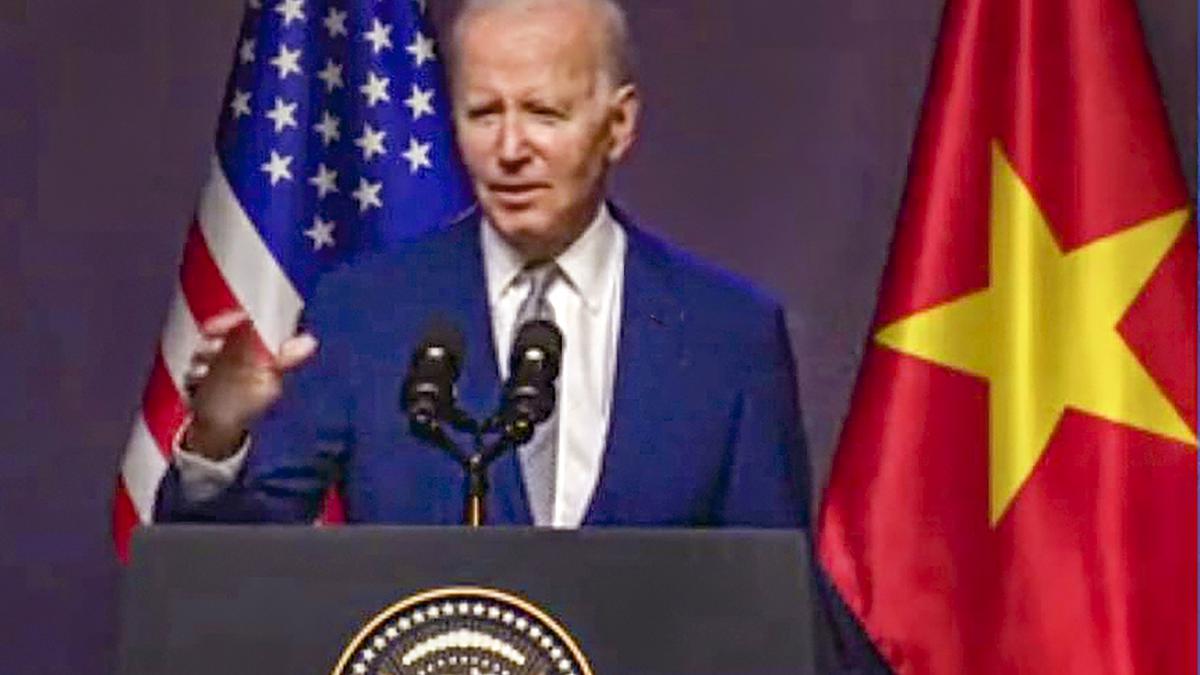

| Photo Credit: Reuters

The rupee rose 2 paise to 83.71 against the U.S. currency in early trade on July 31 following a marginal dip in the dollar in overseas markets.

At the interbank currency exchange, the domestic currency opened at 83.72, 1 paisa higher than the previous day’s close.

The domestic unit moved in the tight range of 83.70-83.72 in early trade.

Forex traders said the rise in Brent crude oil prices offset the rupee’s gains following the decline in dollar rates overseas.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, declined 0.19% to 104.36.

Brent crude futures—the global oil benchmark—rose 1.49% to USD 79.80 per barrel.

Also Read: Sensex, Nifty retreat from record highs to close flat ahead of key US Fed rate decision

All eyes will be on the U.S. Fed rate announcement later in the day. Expectations are ripe that the Federal Reserve might signal a rate cut as early as September.

In the domestic equity market, the 30-share BSE Sensex showed volatility, rising over 200 points in early trade to reach a record high before trading at 81,517.75, up 62.35 points, at 9.35 a.m.

“Foreign institutional investors were net sellers in the capital markets on July 30, offloaded shares worth ₹5,598.64 crore,” according to exchange data.